May Private Client Letter - Sell in May and Go Away?

/The Federal Reserve and Chairman Jerome Powell will hold its latest policy meeting on Wednesday, May 3rd. The central bank is largely expected to deliver on another 25-basis point hike to the Fed Funds rate, bringing the benchmark rate to a range of 5.00% - 5.25%. This would mark the 10th straight rate hike this cycle and take the Fed Funds rate to its highest level since 2007.

As I have been observing for many months now, there is an important lagged effect stemming from higher interest rates. The full impact of the Fed’s campaign to tighten financial conditions, and thus slow the economy, will not be felt for many more months. This, as the economy continues to sharply decelerate, calls into question the possibility of a monetary policy mistake in which the Fed triggers a deeper or longer recession than has been widely expected.

Economic activity has become increasingly uneven in recent months. Real Gross Domestic Product (GDP) grew at a soft 1.1% annual rate in the first quarter, significantly lagging consensus expectations. Moreover, the growth was almost entirely due to consumer spending on purchases of motor vehicles, while business investment in equipment, which is a reliable indicator of future productivity growth, declined at a 7.3% annual rate. This marked the fastest drop in business investment since the COVID pandemic started.

Problems in the banking sector continue with JP Morgan’s takeover of First Republic Bank, marking the second largest bank failure in U.S. banking history. JP Morgan said it will assume all of First Republic’s $92 billion in deposits; insured and uninsured. It is also buying most of the bank’s assets, including about $173 billion in loans and $30 billion in securities.

While conditions may have calmed following the recent “bank runs”, the turmoil may not be over yet. The risk remains high of more problems emerging in the banking system from the rapid and sharp increase in interest rates. There’s also the question of how much credit conditions will tighten in the wake of the turmoil, and what this means for the economic outlook.

Our base case remains one of heightened concern and caution. According to the U.S. Small Business Administration, small businesses generate about 44% of national economic activity and they create two-thirds of net new jobs.

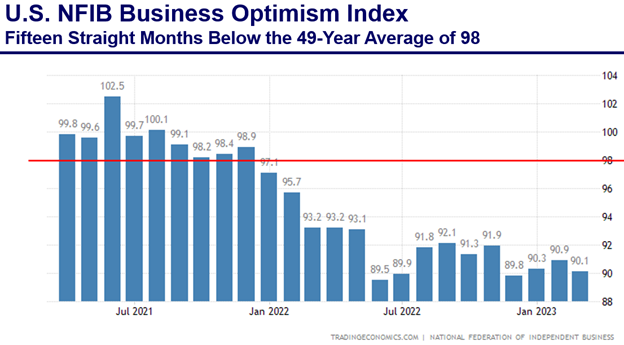

The National Federation of Independent Business' ("NFIB") latest release of its Small Business Optimism Index paints a shocking picture of just how tough conditions are becoming on Main Street. That index marked 15 consecutive months of declines with readings well below its 49-year average of 98 (chart above).

When it comes to the stock market, there is an old seasonal market adage that says to "sell in May and go away." This stems from the stock market's tendency to exhibit weaker returns during the months of May through October compared to the period from November through April. Given the asymmetry of current risks (skewed to the downside), this maxim may be tempting to investors.

There may be some truth to the "sell in May" trade, yet it is not a hard and fast rule. The chart below shows the S&P 500’s (post WWII) and Nasdaq’s median performance and consistency of positive returns in the six-month periods from 10/31 through 4/30 (winter) and 4/30 through 10/31 (summer). Starting with the S&P 500, the index's median performance during the winter months has been a gain of 6.2% with positive returns 75.6% of the time. (BESPOKE)

During the summer months, however, the S&P 500’s median return was less than half that at 3.0%. Along with weaker median returns during the summer months, the S&P 500’s consistency of positive returns at 65.4% has been 10 percentage points weaker than the winter period.

Aside from these observable historical patterns in the stock market, we will be closely monitoring the debt ceiling debate over the next two months. Having previously raised the debt ceiling some 78 times, investors may have become too complacent over this issue. With political tensions running extraordinarily high, there are serious risks of heightened market volatility if this debate runs into the 11th hour, or worse.

While we do not advocate for market timing strategies such as “Sell in May . . .”, we are maintaining relatively high cash, and cash equivalent, positions in our strategies. We believe it is prudent to be defensive at this time. Our view is that earnings estimates will move lower and valuation levels will contract as the economy dips into recession. This combination may make it difficult for equities to hold their previous bear market lows from last October.

We do recognize that the economy has thus far been remarkably resilient to the Fed’s 500bps hike in the Fed Funds rate, and there are some notable factors that are trending in positive directions. Inflation, for instance, is clearly easing and the Fed may soon pause any further tightening. Profit margins for corporate America have declined but remain relatively healthy, as do the balance sheets of the nation’s largest banks. Negative sentiment levels are consistent with past troughs and the markets will eventually look through the current storm clouds.

For the moment, however, investors should recognize that conditions could get worse before they get better. The good news is found in the belief that conditions will eventually get better.

As always, thank you for your continued confidence as we navigate this challenging part of the economic cycle. Please reach out should you have any questions or concerns.

John E. Chapman

Chief Executive Officer

Chief Investment Strategist