Special Year End Report – December 2022

/We had generally expected 2022 would be a year in which a recession was unlikely and pent-up demand lingering from the COVID pandemic would fuel continued economic growth. It looks like we may have gotten at least one of those expectations right. In our Outlook 2022 report we even observed that the Fed would likely “begin raising rates in 2022, as soon as March”, which is exactly what they did.

What we missed was how badly our government officials misjudged the threat of inflation. After the Federal Reserve and Treasury Department had for months insisted that inflation would be “transitory”, they realized their error and began the most aggressive reversal of monetary policy ever. And at about this time, Russia invaded Ukraine giving us the first major military conflict on the European continent in over 70 years.

Only three months into the year we realized our original expectations for 2022 had gone out the window

This will be my final commentary for 2022, and frankly I will be content to turn the page on this most challenging year. Our research will continue early next year with the publication of our Outlook 2023 report in January. We look forward to sharing a new digital summary of this report along with a printable PDF of our traditional format. But for now, I offer a few final thoughts as we prepare to move into a new year.

In many ways, 2022 will go down in history as a pivotal year for the global economy and markets. The year gave us a highly unusual outcome in which both stocks and bonds generated negative performance for the year. Since the 1980s, a portfolio of 60% stocks and 40% bonds had consistently produced favorable risk adjusted returns (at times approximating the S&P 500 Index). However, this long-established classic strategy, preferred by many “moderate risk” investors, delivered terrible results in 2022. In fact, only two calendar years, both during the Great Depression, have been worse.

Making things even crueler, when adjusted for inflation, 2022 will likely be the worst year ever for the 60/40 portfolio. This said, we do not believe investors should walk away from this balanced approach for total return. Past instances of 60/40 drawdowns have delivered strong performance in subsequent calendar years. We have spent most of this past year adjusting the components of this strategy. We remain confident that our clients will see improving returns in 2023 as attractive low-duration yields begin to contribute more robustly to total returns.

The Fed’s delayed response to the threat of inflation quickly became the only story that really mattered this year. Over the prior 22 years, the Fed had not moved interest rates by more than a quarter-point at any one time. This year they have done it six times (four times at three-quarters of a point and twice at a half percentage point). The fed funds target rate, now in the 4.25 to 4.50% range, is at its highest level since December 2007. Last week’s increase capped a year in which the FOMC raised short-term interest rates at the fastest clip in four decades.

Just a year ago, the Fed indicated they would raise the fed funds rate a grand total of three 25 basis point (bp) rate hikes by the end of the year. One could say they overshot that target by more than a little.

Still, it is now said “their work is not done” and following the December 2022 FOMC meeting Chairman Powell dashed any hopes of a Fed pivot by saying, “it is our judgment today that we are not in a sufficiently restrictive policy stance yet, which is why we say that we would expect that ongoing hikes will be appropriate.” In other words, the Fed intends to carry its hawkish perspective into 2023 with multiple rate hikes likely. The markets do not appear to have fully priced in further rate hikes and investors should brace for more volatility with notable pullbacks along the way.

As Milton Friedman stated many years ago, policy rate hikes act only after a long and variable lag, so there is a legitimate risk the Fed, at least has already hiked rates to fairly restrictive levels - even as they plan more increases to come.

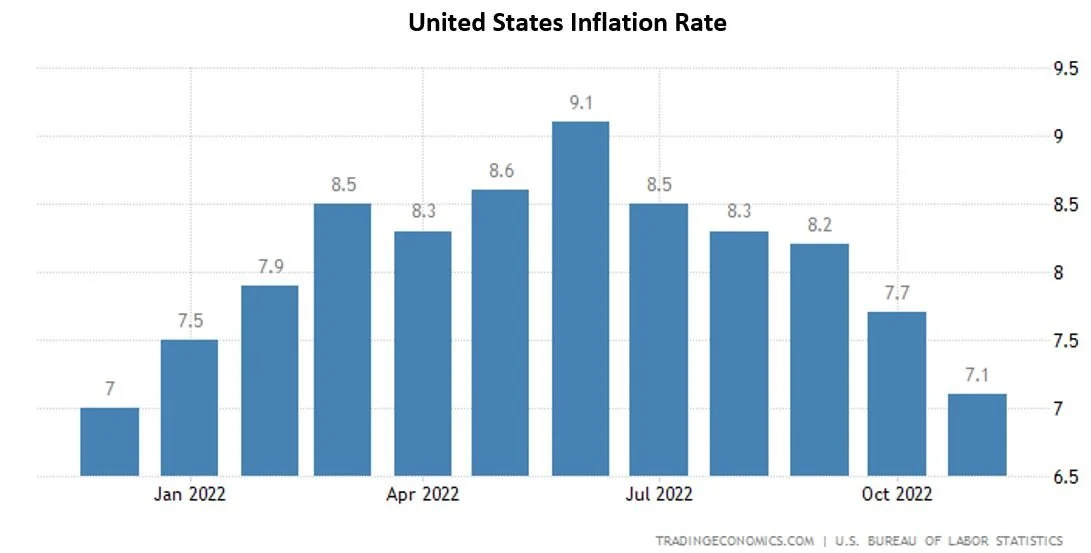

Recent inflation data suggest it may be trending lower. According to the Labor Department, the consumer price index (CPI) measure of inflation rose by 7.1% year-over-year in November. This represented a notable improvement from the 7.7% rate posted in October and is a significant decline from June’s 9.1% peak.

The Fed is now forecasting slower economic growth, with the GDP growth estimate for 2023 coming down from 1.2% to just 0.5%. Even with this anticipated weakness in the economy, most Fed officials are still indicating they expect rates to be higher for longer, even well above 5% next year. This said, one must remember the Fed’s projections overall have been horribly wrong over the past two years.

Our view has been that inflation peaked early summer, and the latest reports would appear to confirm this. While we believe the rate of inflation will continue to fall from the 40-year highs seen earlier in the year, it will not reach the Fed’s target level of 2% for at least several years.

Consumer buying power dropped sharply in 2022 and retail sales declined 0.6% in November. This reading came in well below the consensus expectation for a decline of just 0.2%. Although overall retail sales are up 6.5% from a year ago, that pace is not keeping up with the rate of inflation, with the CPI up 7.1% over the same period.

And therein lies the problem with inflation, consumers are spending more, but they are taking home fewer goods than they were a year ago. In other words, “real” retail spending (inflation-adjusted) are actually lower versus a year ago.

With economic leading indicators now falling, the yield curve seeing its deepest inversion since 1981, and earnings estimates expected to come down in early 2023, it is hard to see how our economy avoids a recession – especially as the Fed is committed to driving interest rates higher. A recent Conference Board survey that found 91% of U.S. CEOs expect a recession next year. Frankly, given the broad deterioration in economic data over recent months, a recession shouldn’t be a surprise to anyone at this point.

The question now becomes how severe this expected recession will be. We believe there is notable resiliency in the current economy, despite the growing uncertainties. Systemic damage has been limited so far and we think a recession in 2023 would likely be of the “short and shallow” variety.

By the second half of 2023 we anticipate the worst will be behind us and a new recovery will be taking shape. After a year of negative returns, there is a lot at stake in the coming months and investors should contemplate how new bull markets are historically born well before recessions officially end.

Market bottoms are typically reached when the news cycle remains awful, and markets are usually materially higher by the time the news turns more positive. Forecasting exactly where the bottom will be reached, or when markets will begin to rally, is entirely impossible.

As we approach the end of the year, we continue sorting out the damage of this ongoing bear market. Bear markets are defined by market declines of 20% or more. The average bear market since WWII has lasted 11 months with an average decline of 29.8% in the S&P 500. This bear market will reach the one-year market on January 3, 2023, making it longer than the average bear.

Bear markets without recessions have typically been shorter, averaging 7.1 months. They are also a bit shallower with an average decline of 23.8% for the S&P 500. On the other hand, bear markets accompanied by recessions have historically been longer, lasting 15.2 months on average. They are also deeper with the S&P 500 declining 34.8% on average.

The historical perspective suggests this bear market has at least several more months to go and we believe a retest of the October lows is entirely possible early next year. The Fed’s persistently hawkish messaging has destabilized equity markets for most of the year and this will not likely change anytime soon.

Despite the current bear market, investors must consider that over the three calendar years (ending in 2021), the market experienced price returns of 29%, 16%, and 27%, respectively. An eventual consolidation of these gains was almost certain to happen at some point.

With only a handful of trading days remaining in 2022, market participants are looking for the “Santa Claus” rally, which according to the Stock Trader’s Almanac technically constitutes the last five trading sessions of the year and lasts through the first two trading sessions in January. By mid-December the S&P 500 was trading near the key technical level of 3,900. By some measures equities remain oversold and Santa could still bring an upside surprise.

Conclusion:

As this difficult year draws to a close, there are two observations that can be made with certainty. The first is that U.S. policy makers have managed to make the difficult COVID pandemic worse through a series of misguided economic policy decisions that shut down the economy and flooded our system with an unprecedented wave of liquidity.

These policies simultaneously destroyed the supply of goods and services, while triggering a surge in the rate of inflation not seen since the 1970s. To make matters worse, these policy makers confidently claimed that inflationary pressures would be temporary, as they watched the economy begin to unravel. It is not surprising that equities slipped into a bear market. This is the bad news.

The good news is that there is a great deal of pessimism in the market as we turn our attention to 2023. Maybe too much. Currently there is a sharp inversion in the yield curve and a dynamic with the 2-year yield now being below the new Federal Funds target range. The market appears to not believe the Fed will keep rates elevated as long as they are suggesting.

According to the latest dot plot, the Fed has yet to convince traders that it is serious. Or maybe more likely, traders know the Fed has a penchant for forecast revisions. Accordingly, we should not be surprised if the Fed revises the expected peak fed funds rate as inflation, including the sticky components, starts to moderate. Any suggestion of a less hawkish Fed would greatly reduce the risk of an ugly recession and likely trigger a meaningful market rally.

The end of one year and beginning of another is often a time of transition and renewal—a time for looking ahead, setting goals, and rethinking priorities. Looking ahead we are encouraged by knowing good times have always followed bad times. This bear market will eventually come to an end and a new bull market will begin. This new bull market will likely drive equity prices to new all-time highs.

It is said that patience is a virtue and, as one of my favorite clients said to me just the other day, good things come to those who wait. Still, waiting can be painful and the urge to “do something” can be intense. We understand this. Please know that after many adjustments to our strategies over the past year, we believe our clients are well positioned to look through the current storm to better days ahead.

We at Clearwater Capital Partners wish to take this opportunity to express our appreciation for your continued confidence. We also recognize that your confidence is even more meaningful as we work our way through times of stress and uncertainty. Thank you.

We also want to wish you and your loved ones every happiness this holiday season.

John E. Chapman

Chief Executive Office

Chief Investment Strategist

December 2022