Why Diversification Still Matters

/Diversification of your investment portfolio is the first step in risk management. The thesis being that having your investments spread out between different asset classes provides safeguards against adverse market cycles and minimizes risk of loss to your overall portfolio. If one area of your investments is underperforming, another area should be doing well to offset the loss.

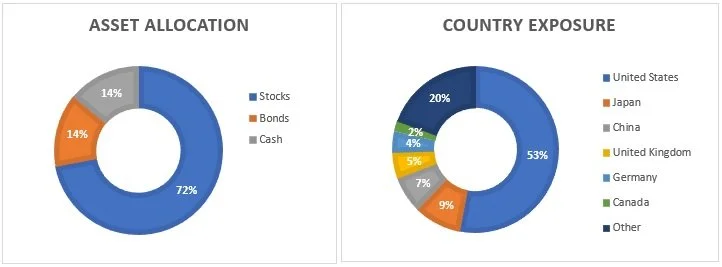

Keep in mind diversification comes in many shapes and sizes, starting with Asset Allocation. This is how your portfolio is spread between asset classes, like stocks and bonds, and is most often represented in a pie chart. Additional considerations with allocation include country exposure and time horizon. For example, if all your holdings are from companies in one country, you could be missing out on growth opportunities in other regions. If all your bonds are of similar durations, you could be on the wrong side of the yield curve suddenly causing the “less risky” portion of your portfolio to be putting you at a greater risk.

Examples of Portfolio Asset Allocation:

Be aware, a standard asset allocation of various mutual funds, exchange traded funds, stocks, and bonds may not be as diversified as you think. For example, you may own four different growth funds from four different fund families, but the top holdings of each could all be pretty much the same. This has become especially common considering FAANG stocks represent approximately 20% of the S&P 500. (FB, AMZN, AAPL, NFLX, GOOG)

To ensure your portfolio is strategically diversified for adequate risk management, it’s critical to further analyze each investment and calculate their correlations. Positions that have low or negative correlations tend to counteract and move in different directions.

The bottom line is risk is an essential part of investing. With proper planning, you can ensure the diversification across all your investments is developed enough to help weather the ups and downs of a volatile market. The goal of risk management is to provide as much downside protection while maximizing potential gains. Working with a professional financial advisor can help keep you on track and ensure your investments are maintaining a proper diversification in line with your personal time horizons, risk level and financial goals.