Currency update - U.S. dollar - why has the dollar strengthened against foreign currencies and what has been the effect of a strong dollar on the global economy, inflation and investments?

/As I write this article, my daughter happens to be on a flight to Italy where she will be visiting a friend. For those who know me and my background, it is probably not a surprise that one of the things that I pointed out to her prior to her trip was the timeliness of her visit because of how cheap it currently is for Americans travelling to most countries outside of the U.S., including Italy.

The reason for this is that the dollar is currently very strong against most developed market currencies around the globe, including against the Euro where it is at a 20-year high in the exchange rate. This means that anyone who needs to exchange dollars into Euros will receive more Euros compared to even a few months ago (i.e. it is currently quite a bit cheaper for American tourists travelling abroad!).

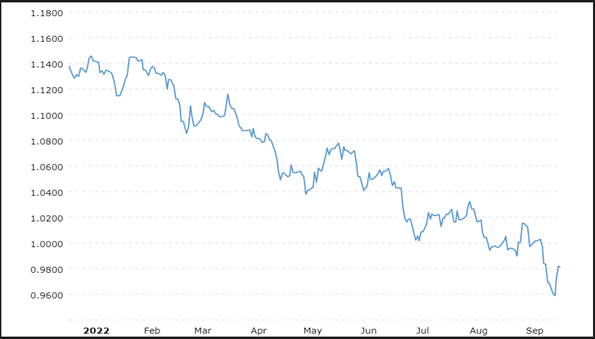

In fact, the dollar has appreciated over 16% since January as of the end of the 2022 third quarter market close as shown in the following price trend chart (Table 1) illustrating the declining value of the Euro versus the dollar:

Table 1

Yes, from an exchange rate standpoint, it is a terrific time for Americans travelling just about anywhere throughout the world, but there are many other considerations that need to be understood regarding the impact of a strong dollar. Those considerations include the effect that a strong dollar can have on the global economy, inflation and investments.

What are some of the reasons for the dollar appreciating in value recently?

Exchange rates at any given time reflect the demand for one country’s assets compared to another and much of the rise in the U.S. dollar recently reflects the current attractiveness of U.S. investments compared to those outside of the U.S.

One of the drivers for the relative increase of capital flows into U.S. assets over the past several months has been the difference in monetary policy here in the United States compared to other countries. Starting in early 2022, Federal Reserve Board Chairman Jerome Powell and the Federal Open Market Committee (FOMC) became determined to tackle inflationary pressures in the U.S. economy and in conjunction with this, the Federal Reserve (“Fed”) began the process of tightening monetary policy.

After having maintained the target range for the Federal Funds rate (the overnight borrowing interest rate for bank reserves, which influences other lending rates including the prime interest rate from which various mortgage, personal loan, credit card and deposit rates are based) at a target range of 0-0.25% since March of 2020, the Fed has rapidly increased this range to where it currently stands at 3-3.25%.

The Fed has indicated through their recent comments that more increases in the Fed funds rate are likely to happen when the FOMC meets again in November and December. The markets have been adjusting over the past several weeks to what is expected to be a continuation of this tighter monetary policy scenario.

In fact, the Fed has hiked rates at a faster pace and more often this year than most developed country Central Banks, such as the European Central Bank. Because of the widening of interest rate differentials between the U.S. and other countries, capital has been attracted to U.S.-denominated assets (such as U.S. Treasury bonds). In the process of purchasing U.S. assets, foreign investors must convert their local currency into dollars, which in turn pushes up the value of the dollar versus the local currency.

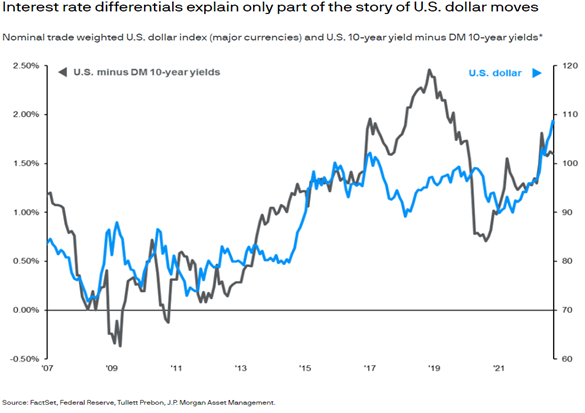

But it is not simply interest rate differentials and investors seeking higher U.S. yields which is helping to push up the value of the dollar versus other country currencies this year (Table 2). Other important factors have influenced an increased flow of capital into U.S. assets over the past year including:

· Safe-haven currency: The U.S. dollar, being associated with the largest economy in the world, is viewed as a safe-haven currency. During times of heightened geopolitical uncertainty, such as now with the ongoing Ukraine/Russia conflict and the spillover effects that this has caused throughout the world, foreign investors have piled into U.S. assets for safety. The flow of foreign investment from this “flight to safety” pushes up the value of the U.S. dollar when those foreign currencies need to be converted into dollars.

· “Petro-Currency:” The U.S. dollar has benefitted from its position as a “petro-currency” (Franklin Templeton, September, 2022).

Over the past several years, the United States has become energy self-sufficient to the point where it has become a net exporter of oil and natural gas. The global disruptions to energy markets unleashed by Russia’s invasion of Ukraine have had a net positive impact on the value of the dollar because of the increased demand for U.S. energy on the global market, particularly in areas such as Europe and the UK, which had previously been reliant on Russia to meet their energy needs.

Table 2:

How has the stronger dollar impacted the global economy, inflation and capital markets?

Global Economies and Inflation: For the U.S. economy, an appreciating dollar as we have experienced this year makes U.S. exports more expensive and imports cheaper. This can lead to a larger trade deficit, which will have a dampening effect on U.S. Gross Domestic Product (GDP) growth.

The impact of currency moves on broad measures of growth such as GDP can be overstated though. For large economies like the United States, Europe and Japan, international trade comprises less than 20% of total economic output. In other words, a strong dollar alone is unlikely to worsen the outlook for growth significantly.

Despite that, policy makers often welcome a weaker home currency in order to boost exports and subsequently, economic growth.

Similarly, currency moves typically do not have a major long-term effect on inflation in major economies. Currently, the stronger dollar has resulted in lower import costs which have provided a dampening effect on U.S. inflation.

With the current increase in global inflation, a currency that is declining in value will have the added effect of fueling inflationary pressures at home even further. Inflation is an even larger challenge for those countries with a weak currency who are dependent on importing higher priced energy and commodities, which has occurred for much of 2022.

Because commodities like oil and wheat are also priced in dollars, the effect of an increase in the dollar price of these commodities is exacerbated for countries that have seen their currencies decrease in value against the dollar.

Low-income countries and many emerging markets have been particularly hit hard by the strong dollar. Along with higher food and fuel prices, many of these countries have also borrowed in dollars and paying back these dollar-denominated loans has become more expensive as the dollar has strengthened. For most low-income countries, dollar appreciation has translated into higher import prices, more costly external debt servicing and greater risk of financial instability.

Capital Markets: A persistently strong dollar will impact capital flows, the shape of yield curves, the cost of capital and the redistribution of profits. Each of these impacts can have important effects on asset class returns.

While stronger relative growth and returns have propelled the dollar higher this year, it has also resulted in a shift of relative asset valuations when factoring in domestic purchasing power. For example, not only does the U.S. stock market continue to trade at a higher price-to-earnings (P/E) multiple than European and Japanese stock markets, but purchasing shares of U.S. companies by European and Japanese investors has become increasingly expensive due to their weaker domestic currencies.

In 2022, a strong dollar has imparted a widespread tightening bias to global monetary policy (i.e. when the Fed hikes interest rates, other Central Banks follow) as most developed countries have followed the Fed’s lead. These Central Banks have raised their interest rates in order to help reduce inflation, maintain the attractiveness of their country for global capital investment, and stabilize the value of their currency in foreign exchange markets.

This year’s dollar strength, which has been propelled by aggressive Fed tightening due to higher inflation, has also played a part in increasing volatility in not only the currency markets, but in other areas of the market as well.

How does a stronger dollar affect U.S. company profits?

Roughly 1/3 of total S&P 500 company revenue and profits are sourced from doing business overseas (i.e. in other currencies). When the U.S. dollar appreciates, U.S. large multinational companies with huge overseas operations such as Microsoft and Apple will receive fewer dollars from those foreign currency profits (Table 3).

Table 3:

On average, from a company sector standpoint, technology companies within the S&P 500 generate the largest percentage of their sales outside of the United States (59% of sales, according to Goldman Sachs, July 2022). Many of these large technology companies have highlighted the negative impact to their firm’s earnings from the strong dollar during recent quarterly earnings announcements.

For example, Salesforce Inc. announced that it expects to have an $800 million reduction from its full-year sales, which is a $200 million increase from earlier forecasts (Source: Bloomberg, September, 2022).

In aggregate, each percentage point of year-over-year increase in the U.S. Dollar Index (DXY), which measures the dollar against 6 other developed country currencies, historically has translated into a 0.5% hit to S&P 500 company earnings growth (Source: Morgan Stanley, July 2022).

Keep in mind that American companies with a more limited international physical presence could actually see a significant benefit from the lower relative cost of imported goods in a stronger dollar environment. Most small companies in the U.S. would fall into this category (i.e. companies in the Russell 2000).

How has the stronger dollar affected those investing in international companies?

Foreign companies that export goods and services to the U.S. are benefiting from the competitive edge that their weaker currencies give them. Not only are their stocks cheaper when priced in dollars, but so is everything that they sell.

The problem lies with the currency conversion for the U.S. investor when those weaker currency profits are transferred back into U.S. dollars. Evidence of this can be seen in the year-to-date performance difference between the iShares MSCI EAFE ETF (EFA) and the iShares Currency Hedged MSCI EAFE ETF (HEFA).

Through the 3rd quarter, the performance for EFA and HEFA has been -27.08 and -12.89 respectively. With both funds holding the same basket of international stocks, the performance difference of 14.19% has been solely due to currency volatility.

The currency-hedged investment option noted here allows an investor to be neutral with no opinion either way regarding the direction of the U.S. dollar. The foreign investment will subsequently generate returns that specifically reflect the return of the stock in its local market. Take note that in a scenario where the U.S. dollar weakens and foreign currency profits are exchanged back into U.S. dollars, the U.S. investor would be better off by not hedging out the currency (Hedging Currency Risk when Investing Internationally, Davis, Clearwater Capital Partners, – December, 2016).

Summary

In September, 1985 following a period of U.S. dollar strength against global currencies, delegates of the G5 countries met and created an agreement called the “Plaza Accord.” The agreement called for coordinated actions to depress the value of the dollar, including the massive sale of U.S. dollars in the foreign exchange market by each of their Central Banks. Because of current geopolitical dynamics and the fact that the Fed appears to be satisfied with the inflation dampening effect of a stronger dollar, such a Central Bank agreement at this time is unlikely.

Despite this, it is important to be mindful of the fact that currency trends can reverse very quickly from one moment to the next. Currently, there are a variety of events that could cause such a trend reversal.

Those would include:

1. A change in rhetoric by Federal Reserve governors and subsequently Fed policy towards a less hawkish monetary policy tilt (i.e. not increasing interest rates at the current expected pace).

2. Evidence that economies outside of the U.S. are starting to perform better and are becoming more attractive for capital investment opportunities when compared to the U.S.

3. A reduction in current geopolitical tensions, including the Ukraine/Russia war and the energy crisis in Europe.

4. An agreement by global leaders at the G20 summit in November that could set the table for programs to cap the dollar strength.

Understanding that past performance is no guarantee of future results and realizing that it is very difficult to predict short-term changes in currency trends, such as the current trend involving the strong dollar, it is still interesting to look back at previous periods and see how the stock market has performed after the dollar had peaked. Over the past 40 years, peaks in the dollar have been followed by rallies in the S&P 500 by an average of 10% over the next 12 months (Reuters.com, July, 2022).

For this reason, despite the fact that those investing in international stocks on a currency-hedged basis benefited this year due to the strength in the dollar, investors should not dismiss the fact that allocating to international equities on an unhedged or partly hedged currency basis in order to potentially benefit from a reversal of this year’s strong dollar trend could be a wise move as we enter 2023.