Choosing the Right Retirement Date

/Deciding on your retirement date can be one of the most important decisions in your lifetime. Here are three steps to take the guesswork out of choosing a date that is right for you and your retirement plan:

STEP ONE – RUN THE NUMBERS

Hope is not a financial strategy. Until you have extensively run the numbers on how much you have in savings, how much you expect to spend, and how much you anticipate earning, you risk leaving the task of choosing your retirement date to guesswork. Here is the data to gather.

How much do you currently have in savings, retirement, and investment accounts?

What are your monthly expenses?

What lifestyle expenses should you plan for? This could include an annual travel budget, the purchase of a new vehicle every 5 years, or annual country club membership dues.

What sources of income will you have in retirement? Include social security, pensions, royalties, RMDs, and any earned income from part-time work.

A proper retirement financial plan should incorporate all the above elements.

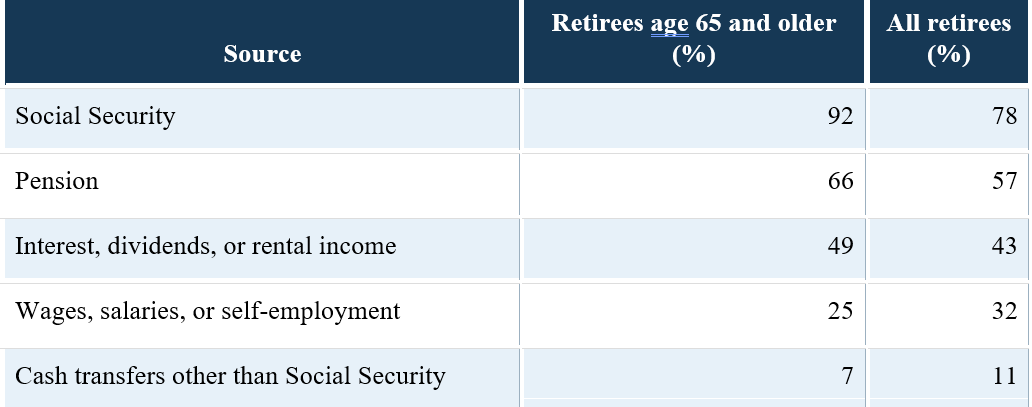

Sources of income in the prior 12 months among retirees (by age). Respondents could select multiple answers.

Sources of income include the income of a spouse or partner. (Federal Reserve Board SHED Survey 2021)

STEP TWO – CONSULT WITH YOUR EMPLOYER’S HUMAN RESOURCES

Depending on your tenure, role, and size of organization, you may need to coordinate your retirement up to 3 to 6 months prior to the actual date. Here are a few questions to ask your HR Department before choosing your retirement date.

“What is my effective date vs. last day of employment?”

Your benefits coverage may extend beyond your last day in the office. Find out when your existing coverage ends and enroll in new benefits as needed. For example, you may need to coordinate enrollment in your spouse’s employer sponsored plan, COBRA, or Medicare to eliminate gaps in coverage. Find out how your unused Paid Time Off will be administered. Some employers pay this out in the retiree’s final paycheck, while other employers require all accrued PTO to be used prior to an employee’s actual retirement date.

“Am I fully vested in my retirement account?”

If your employer has been making contributions into a retirement account on your behalf, you may be subject to a vesting schedule. When you end employment prior to being fully vested, you may forfeit all or a portion of the employer-provided contributions. Your vesting schedule can be found in the Summary Plan Description or obtained directly from your Plan Administrator.

“What is my eligibility date and distribution options for retirement payouts?”

Deferred compensation arrangements, pensions and executive benefit plans come in a variety of shapes and sizes. Carefully review your plan to understand any potential age + years of service calculations, payout waiting periods, or other restrictions. Before electing a distribution option, which may include taking a lump-sum payment vs. establishing an annuity schedule, consult with your wealth advisor to understand the impact on your retirement financial plan.

“How will the company handle my retirement announcement?”

Consider the impact of your retirement on your co-workers and organization. Will you be actively involved in training your successor? What is the communication plan to your customers, business partners, and other stakeholders?

Once you have decided on your retirement date, submit a formal notice in writing. Providing a formal written notice of your retirement plans can ease the transition for both you and your employer. Sharing the news publicly can also be a huge emotional relief, as you no longer must keep the announcement to yourself.

STEP THREE – SET GOALS FOR YOUR NEXT CHAPTER

Start with a vision for what you want your retirement to look like. Do you want to travel more? Do you expect to spend more time with friends and family? What are you looking forward to most? Include your spouse or partner in the conversation and set retirement goals together.

LIFESTYLE GOALS differ from standard of living expectations. To set lifestyle goals consider things like where you want to live, how you want to travel, and what kind of hobbies will consume your time. Discuss your lifestyle goals with your wealth advisor to confirm you will not outspend your retirement income and savings.

HEALTH GOALS might include staying physically fit by taking up a new sport like pickleball or focusing on nutrition in an effort to reduce out of pocket healthcare expenses and remain healthy longer. According to the Centers for Medicare and Medicaid Services, costs in the health spending share of GDP will increase from 18.3 percent in 2021 to 19.6 percent in 2031.

LEGACY GOALS can be a strategic component to your overall estate plan, helping to protect your assets and ensure your wealth is transferred efficiently to your beneficiaries. Non-financial legacy goals can be a rewarding part of your retirement plan incorporating how you intend to give back through volunteering of your time and life experience. For example, you may want to serve on a nonprofit board or participate in mission trips with your church. Creating a legacy plan that includes both financial and non-financial goals, ensures you are passing on your assets, beliefs, and values, while making the maximum impact to your heirs and community

Choosing your retirement date is an exciting milestone and can be one of the most important decisions you will make in your lifetime. To take the guesswork out of your retirement planning, reach out to your Clearwater Capital advisor and schedule a meeting with our Advanced Planning team lead by Kevin Nolte, CPA