Year-End Financial Checklist

/Year-End Financial Checklist

Year-end marks several critical financial deadlines and cut-offs you can’t afford to miss. Here’s a year-end financial checklist to help you maximize savings, minimize taxes, and ensure your financial goals are on track.

REVIEW YOUR INCOME

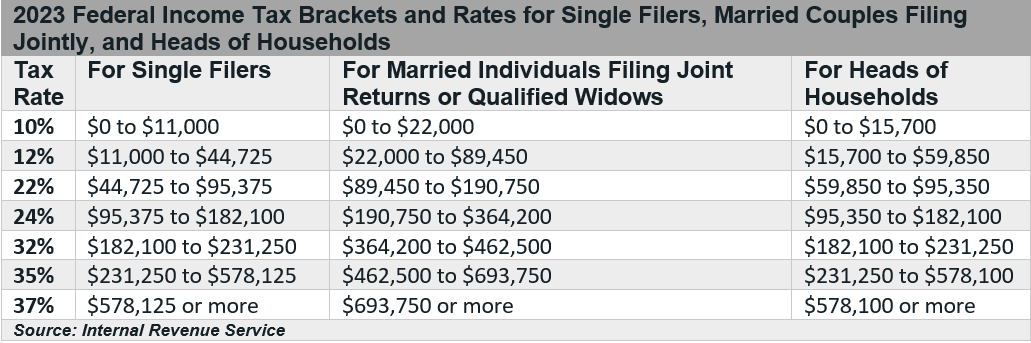

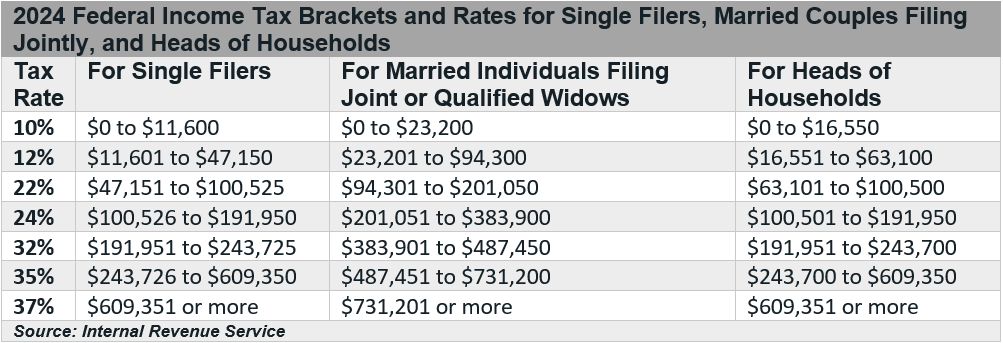

In addition to reviewing all year-to-date (YTD) income received, now is a good time to forecast any additional income you expect to bring in before the end of the year. Guage the tax implications of any additional income you’ll receive between now and year-end.

Are you expecting any lump sum bonus, sales commission, or other inflow that could put you into a higher tax bracket?

Has your tax filing status changed this year due to a life event such as marriage or divorce?

Is it advantageous to make a ROTH conversion this year? Partial or Whole? Don’t forget to take the five-year rule into consideration when deciding whether to convert to a ROTH. The five-year rule requires investors to wait 5 years before withdrawing converted balances without incurring a 10% penalty.

INVESTMENT RELATED DEADLINES

The end of the calendar year marks several critical investment-related deadlines that could be costly if missed. IMPORTANT NOTE: For 2023, the final business day of the year is Friday, December 29th. Plan ahead to allow for transaction processing time to ensure you meet each financial institution’s cut-off requirements.

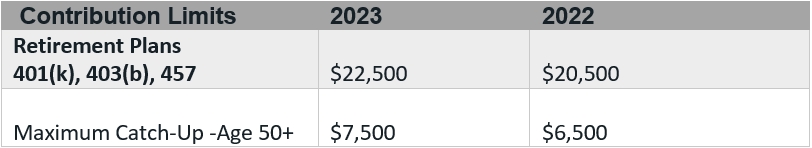

¨ Are you on track to maximize your retirement contribution? Employer-Sponsored 401(k) and 403(b) contributions must be made by Dec. 31st. Coordinate with your human resources or payroll department if you need to make any changes to your final paycheck(s).

¨ Are you subject to a Required Minimum Distribution (RMD)? If you turned 73 this year and are taking an RMD for the first time, you have until April 1 of 2024 to make your withdrawal. However, you’ll have to take BOTH your RMD for 2023 and 2024 before next year-end to meet the IRS requirement. If you inherited an IRA on or after December 31, 2020, you might be subject to the new 10-year rule. Work with your financial advisor to ensure you don’t miss the RMD deadline or you could be subject to an excise penalty for missing the cut-off.

¨ For most states, you have until December 31st to contribute to a 529 plan and receive a state tax deduction or credit. It’s important to refer to your state’s plan to know which deadline applies to you. For example, some plans follow a post mark rule, while others require the contribution be processed by 12/31.

¨ Tax loss harvesting can lower your tax bill by offsetting capital gains with capital losses. It’s important to factor in settlement dates and transaction timelines when coordinating tax loss harvesting to ensure the year-end deadline is met.

CHARITABLE GIVING

There are several strategies to consider when looking to increase your charitable impact while potentially reducing your taxable income. Typically, for charitable donations made by December 31, 2023, you can deduct up to 60% of your 2023 adjusted gross income (AGI) for cash gifts made to a qualifying charity. Non-cash contributions, such as appreciated stock gifts or donations to a qualifying private foundation are generally limited to 30% of your AGI.

¨ Do you have any appreciated non-cash assets to donate directly to charity? This may eliminate the capital gains tax you would otherwise incur. [1]

¨ Does “bunching” of charitable contributions make sense for 2023? The Tax Cuts and Jobs Act of 2017 (TCJA) brought about a substantial increase in the standardized deduction. One effective strategy in taking advantage of the higher deduction and itemizing your charitable donations is known as bunching, which is affectively gifting two years’ worth of donations into one single tax year. NOTE: provisions of the TCJA are set to sunset after 2025.

¨ Are you eligible to utilize a qualified charitable distribution (QCD)? If you have reached age 70.5, you can donate up to $100,000 total to one or more charities directly from your IRA. The QCD counts towards your RMD allowing you to lower your tax bill and potentially prevent being pushed into a higher income tax bracket. As part of the SECURE Act 2.0 legislation, you can direct a one-time $50,000 QCD to a charitable remainder trust in 2023.

PLAN FOR YEAR-END EXPENSES

The National Retail Federation forecast that 2023 holiday spending will reach record levels to between $957.3 billion and $966.6 billion[2]. And while the October inflation reading is a significant improvement from the pandemic-era peak of 9.1%, food costs are still above historical-average rates.[3]

¨ Plan for holiday spending, including increased costs associated with hosting meals and travel.

¨ Are you subject to personal property tax or other expense(s) with a December 31st due date?

¨ Are you planning any purchases that qualify for credits or deductions under the Inflation Reduction Act of 2022? Guidance for taxpayers can be found directly from the IRS on energy-related credits including the purchase of clean vehicles and energy efficient home improvements.[4]

At the end of the calendar year, schedules fill up quickly with business deadlines, holiday events, and travel. I encourage you to put a financial year-end review at the top of your to-do list, to ensure you don’t miss any critical deadlines or cut-offs. Work with your Clearwater Capital advisor to incorporate appropriate strategies for your unique circumstances and financial goals.

[1] https://www.schwab.com/learn/story/12-tax-smart-charitable-giving-tips

2 https://nrf.com/media-center/press-releases/2023-holiday-reach-record-spending-levels

3 https://www.ers.usda.gov/data-products/food-price-outlook/summary-findings/

4 https://www.irs.gov/credits-and-deductions-under-the-inflation-reduction-act-of-2022#energy