November 2023 Private Client Letter

/Caution Remains Warranted

In late October both the Nasdaq and S&P 500 entered correction territory following a weak third quarter for equity prices. The reasons behind falling stock prices have been higher interest rates and weak earnings guidance from corporate executives worried about the threat of an escalation to the war in the Middle East. By the end of the month, the S&P 500 closed about 10% below its recent peak in late July.

In the opening week of November, U.S. equity markets sharply reversed course and surged by more than 5 percent. The apparent catalysts for this strong rally were several softening economic indicators and the Federal Reserve’s widely anticipated decision to maintain the target Fed funds rate at 5.25-5.50%. In what is a widely recognized irony of the capital markets, investors were cheering a weaker economy in the hope the Fed would begin a shift to cutting interest rates in 2024.

The Fed's statement closely resembled that of September, with minor changes in wording. It now describes the economy as growing at a "strong" pace, as opposed to "solid," and notes that employment gains have "moderated" rather than "slowed."

During the press conference, Chairman Powell highlighted two key factors influencing the Fed's decision-making process. First, they are concerned about tightening financial conditions, as higher interest rates on mortgages and corporate borrowing could impact economic activity in the future. Second, they believe that the full effects of their previous policy actions have yet to materialize.

The Fed has clearly indicated that it is prepared to raise rates further if data suggests it's necessary. However, the uncertain path ahead, coupled with geopolitical tensions, the resumption of student loan payments, slowing economic and employment growth, and rising oil prices, could make the Fed's journey more challenging.

Further complicating the inflation story in the years ahead will be more aggressive labor union negotiations for wage increases for their members. Tentative agreements to resolve the recent autoworkers strike call for a 25% increase in pay by April 2028.

JP Morgan Chase CEO Jamie Dimon remarked that the Fed was right to pause, though the JPMorgan chief said, "I think there's a chance that inflation is just a little stickier than people think and their fiscal and monetary stimulus in the last several years is more than people think.” He went on to express the possibility that future rate hikes from the Fed could range from an additional 25 to 75 basis points due to persistently high inflation.

Dimon has been consistently warning about the possibility of surging rates, which could expose those who took excessive risks during the low-rate environment. He stated in JP Morgan's earnings release on October 13 that this could be one of the most dangerous times the world has seen in decades.

Our view is that there is a strong likelihood that the Fed will keep rates higher, and for longer, than many market participants currently believe. Any hopes investors may have for a reversal in monetary policy in 2024 appear overly optimistic to us.

The October employment report showed lower than expected job creation, downward revisions to prior month reports, and a noticeable drop in total hours worked for the private sector in October. This drop of 0.3% for the month was the equivalent of losing about 350,000 jobs (First Trust). As we have previously observed, employment is historically a lagging indicator. In other words, employers generally do not stop hiring, or begin widespread layoffs, until a noticeable economic downturn is established.

Both ISM Manufacturing and non-manufacturing data declined in October. The service sector remains in an expansionary mode, albeit the pace of growth is slowing. Manufacturing, however, has contracted in every month over the past year. Labor pressures, continuing inflation, a potential government shutdown before year end, and geopolitical instability have created a very complicated environment for businesses.

The Conference Board Leading Economic Index® (LEI) for the U.S. fell again in September, marking a year and a half of consecutive monthly declines since April 2022 and signaling economic weakness ahead. While the U.S. economy has shown considerable resilience despite pressures from rising interest rates and high inflation, we do not believe this trend will be sustained for much longer. Thus, our base case continues to call for a shallow recession in the coming months.

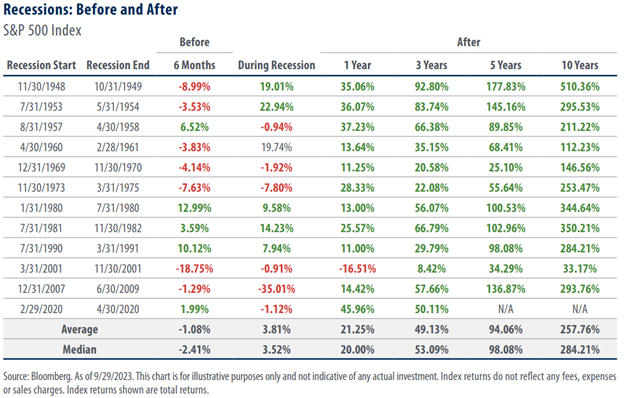

There have been 12 recessions in the U.S. going back to the 1940s. On average U.S. equities have declined over the 6-month period prior to when the recessions began, then turned modestly positive during the recession, and have rallied dramatically as the recessions began to give way to new periods of expansion.

While history never repeats perfectly, we believe it is correct for our strategies to remain neutral at this time, given our view that equities offer limited sustainable upside in the near-term. Over the past year we have consistently added bond exposure as interest rates ticked up and have trimmed equity exposure on rallies.

We do expect the economic downturn we are forecasting will be short and shallow in nature - provided the military conflicts in the Middle East and elsewhere do not escalate. Accordingly, we are beginning to plan for a time wherein the risk reward profile for equities shifts in a positive direction and attractive opportunities emerge. For now, we believe it is wise to remain somewhat defensive.

As always, thank you for your continued confidence in our abilities to help you navigate the many challenges associated with growing and protecting your wealth.

John E. Chapman

Chief Executive Officer

Chief Investment Strategist