The Fed Makes Its Move

/Three years ago, the Federal Reserve (Fed) incorrectly predicted the dramatic spike in inflation that started in 2021 would be short-lived, referring to the sudden increase in prices as “transitory”. Fed Chair Jerome Powell went on to tighten monetary conditions, determined to beat inflation even if it resulted in recession.

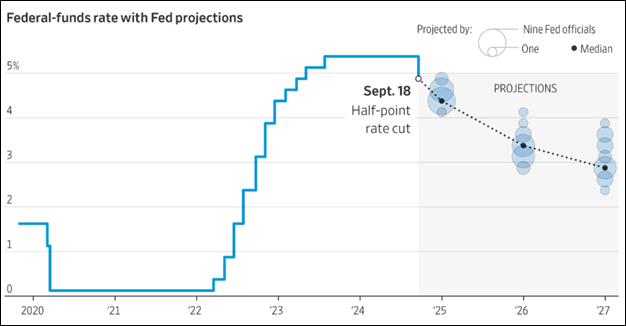

For most of the past year, the primary challenge for investors has been weighing the type of “landing” we might see following a period of 40-year high inflation and an extraordinary monetary tightening cycle by the Fed. The chart below clearly illustrates how aggressive the Fed was in raising the federal funds rate during a 16-month tightening cycle that started in 2022.

At the most recent FOMC meeting (just two weeks ago) we received important signals as to the Fed’s thinking when they opted to cut the Fed Funds rate by 50 basis points – their first cut in over four years. Historically, a rate cut of this magnitude has only occurred at times of elevated economic stress or other types of crises impacting the growth trajectory of the economy.

As the Fed begins a long-anticipated unwinding of tighter financial conditions, the question has become did they pull off a soft landing or have they held interest rates too high, for too long? Just earlier this summer, Fed members forecast it would be appropriate to cut rates once – by 25 basis points – in 2024. Three months on, they appear to have come to a very different conclusion having already doubled the magnitude of their first rate cut and Fed members are now forecasting 50 basis points of further cuts before this year is through.

Source: The Wall Street Journal 9-191-2024

Inflation has fallen to around 2.5% from above 9% in the summer of 2022, not far from the Fed’s 2% target. Key economic indicators, however, are currently flashing weakness in the economy that may signal a downturn in the coming months.

The unemployment rate climbed to 4.3% in July from 3.7% at the beginning of the year. Historically, when the unemployment rate starts rising a little bit, it continues going up – sometimes by a lot.

Low- and middle-income consumers’ budgets are showing strains. Credit card and automobile loan delinquency rates have been rising.

More companies say they’re focusing again on keeping costs down to attract deal-conscious shoppers raising the issue of profitability challenges ahead as margins are squeezed.

The U.S. housing sector, which avoided a downturn that usually occurs when interest rates rise sharply, faces a challenging outlook.

The U.S. Leading Economic Index (LEI) remained on a downward trajectory in August posting its sixth consecutive monthly decline. The Conference Board expects U.S. real GDP growth to lose momentum in the second half of this year as higher prices, elevated interest rates, and mounting debt erode domestic demand.

The path to a U.S. soft landing is being challenged by various sectors of the economy that are struggling with high input prices, rising consumer debt, and in some cases high current inventory levels. For now, corporate profit expectations have been falling but not at an alarming pace. The profit outlook for companies, however, can shift quickly. Many companies have low fixed-rate debt that matures in the next year. Accordingly, they could face a sizable increase in borrowing costs even as the Fed cuts rates aggressively.

The hard landing / soft landing debate continues with the next few months being crucial in determining the outcome. If the Fed succeeds and maneuvers the economy to a soft landing that brings inflation down without a notable downturn in economic activity (and a spike in unemployment), it’ll be a historic achievement. If the Fed fails, the economy will likely slide into what we believe would be a short and shallow recession.

At this juncture, it is important to observe that most economic downturns appear to be soft landings early in their cycle - only to become hard landings in time. Since World War II, the U.S. has convincingly achieved only one true soft landing, in 1995.

If the rate of inflation continues to move convincingly towards the Fed’s 2% target and policymakers prioritize monetary decisions that boost economic growth, the soft-landing narrative remains possible. This posture, however, simultaneously risks a resurgence in the rate of inflation like what happened in the 1970s when the Fed eased financial conditions too quickly.

Given the long and varied impact higher interest rates have on economic activity, we believe it is wise to watch future developments with a degree of skepticism. Geopolitical and domestic political risks also remain elevated, and risk assets are arguably priced for favorable outcomes across a very uncertain landscape. Simply put, the balance between risk and reward remains quite challenging.

As always, thank you for your continued confidence in our abilities to help you navigate the many questions associated with growing and protecting your wealth.

John E. Chapman

Chief Executive Officer

Chief Investment Strategist