The Case for Agency Mortgage-Backed Securities

/As interest rates have risen over the last several years, we have taken steps in fixed income strategies to “lock-in” these higher rates by increasing duration. One of the areas that we have been adding to and continue to favor is U.S. agency mortgage-backed securities (MBS). The MBS market is one of the largest, most liquid segments of the bond market comprising nearly 25% of the Bloomberg Aggregate Bond Index.

A mortgaged-backed security is an investment that is backed by a pool of underlying mortgage loans. There are several different types and issuers of MBS, but for the purposes of this article, we’ll focus on those that are issued and guaranteed by the three government agencies (agency MBS): Ginnie Mae, Fannie Mae, and Freddie Mac.

It should be noted that only securities issued by Ginnie Mae are backed by the full faith and credit of the U.S government. Fannie Mae and Freddie Mac are government-sponsored enterprises (GSE) that are regulated by the government but do not have the explicit backing of the U.S. government even if there may be an implicit backing. Thus, securities issued by these two GSE’s carry slightly greater credit risk than those issued by Ginnie Mae, although all are investment-grade rated and relatively high quality in nature.

While often compared to traditional bond investments like U.S. treasuries, mortgage-backed securities have unique features and risks that need to be considered.

Mortgage-backed securities’ monthly payments are made up of both interest and principal. Whereas traditional bond investments typically make interest only payments periodically with a final principal payment at maturity, these mortgage-backed securities pay principal down over time. These payments can vary based on how quickly homeowners pay down their mortgages.

Mortgage-backed securities are subject to prepayment risk. Occasionally, homeowners pay off their mortgage quicker than expected or can refinance their home when interest rates fall. The risk here for MBS investors is that you receive your principal back at a time when interest rates are now lower, affecting reinvestment opportunities.

Mortgage-backed securities possess extension risk. Contrary to prepayment risk, in an environment where interest rates rise, there is less refinancing activity and there is little incentive for homeowners to pre-pay their mortgages. For MBS investors, this can lower expected coupon payments and extends the time at which investors will receive principal back. This can lower the income that is received to invest at higher interest rates.

In addition to these characteristics, agency mortgage-backed securities will share other risks of traditional bond investing such as credit/default risk, interest rate risk, and liquidity risk that need to be evaluated in making investment decisions.

With these factors in mind, we believe there continues to be tailwinds that favor having Agency MBS positions heavily featured in strategic fixed income strategies:

Agency MBS offer higher yields. To compensate for the unique characteristics of agency MBS, they typically offer higher yields than U.S. treasuries. A common measurement to compare yields/valuations between bonds and treasuries is what’s known as “spread”. Generally, the greater the yield a bond has relative to treasuries, the greater the spread. As shown below, 30yr Agency MBS Current Coupon (newly issued MBS) spreads are near the highest levels they’ve been at in the last 20 years. To give a picture of the yield difference in nominal terms for the MBS index, the avg. yield to maturity (YTM) of the U.S. MBS index is 4.60% as of this writing, whereas the 10yr treasury bond yields 3.82%.

Source: Bloomberg. Data from 6/30/2004 through 6/30/2024.

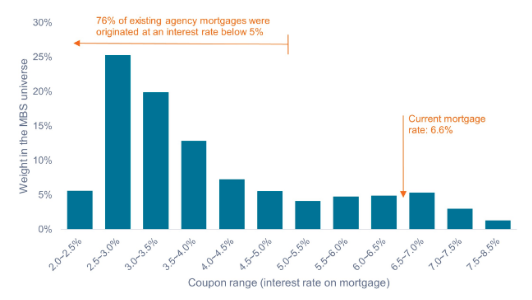

Refinancing/Prepayment risk is lower than normal. As shown below, 76% of mortgages have an interest below 5%. It would take a significant further drop in interest rates to spur a wave of refinances.

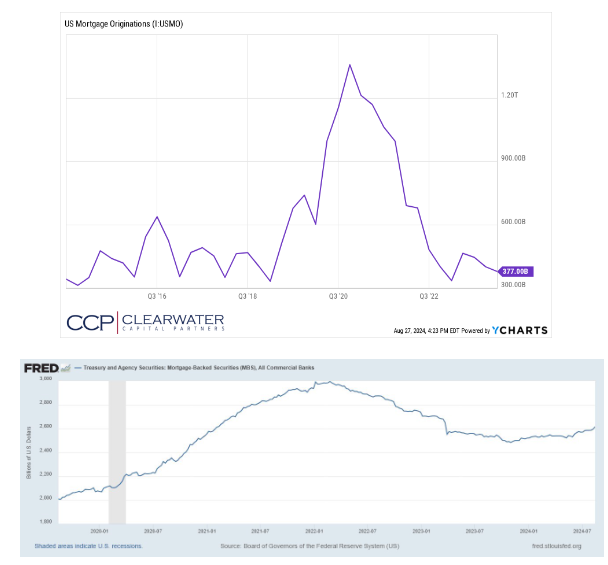

Better prospects for improving supply/demand balance. On the supply side, mortgage originations are stabilizing at low levels. The low origination level is due to lack of ability for homeowners to refinance as they did in 2020-2022, but also fewer home purchases driven by worsening home affordability. At the same time, banks, one of the largest buyers of MBS, have started normalizing and increasing their purchases as deposit bases have stabilized. Limited supply and any pickup in demand from banks should be a net positive for agency MBS.

Interest rate volatility is heading lower as measured by the MOVE index. Higher interest rate volatility typically has a negative impact on mortgage-backed securities as it creates uncertainty surrounding prepayment and extension risk. This uncertainty can lead to spreads widening (bond prices lower relatively) to compensate. As the path of inflation and Fed policy gets clearer, we would expect volatility to continue to stabilize.

Lastly, agency mortgage-backed bonds have historically exhibited strong defensive characteristics during economic downturns. The graph below shows returns by asset class for various fixed income markets along with the S&P 500 during the previous 5 recessions. As denoted in the blue bars, Agency MBS have been resilient in all 5 scenarios acting as a strong ballast to portfolio strategies.

In conclusion, while agency mortgage-backed securities present unique risks and features, their higher yield profile along with attractive technical and fundamental backdrops make them a compelling option for enhancing fixed income portfolios in the current market environment.

20240904 – 5