April Private Client Letter

/The capital markets have been operating in a nervous phase of uncertainty and volatility from the beginning of the year. Investors have been unable to gain any meaningful traction as nearly every traditional asset class has been under pressure.

We are seeing a large-scale conflict between favorable economic data and decent corporate earnings, with a decades-high rate of inflation and the appalling war in Ukraine. Economic fundamentals and growing corporate profits would normally be net positives for the markets. However, high inflation is quickly driving tighter monetary policy and higher interest rates. This, along with ongoing geopolitical distress, are net negatives for the markets.

The American economy is in a very challenging position right now, with risk factors rising. Still, the fundamentals are encouraging. For example, the March jobs report showed a notable degree of resiliency in an economy that continues to expand. The U.S. economy created 431,000 nonfarm payrolls last month, according to the Bureau of Labor Statistics. The unemployment rate now stands at 3.8%, just above its record pre-crisis low of 3.5%,

Continuing unemployment claims are now at their lowest level since the 1960s. With positive revisions to both January’s and February's gains, the U.S. has now recovered about 93% of the jobs it lost at the start of the pandemic, yet payrolls are still 1.6 million short of where they were before COVID.

It is the strong economic data that reinforce expectations the Fed will continue to raise interest rates to fight inflation. We now believe the Federal Reserve will hike rates by 50 basis points in both of their May and June meetings. If there is a positive aspect to all of this, it is that the Fed now seems to understand how far behind it has fallen in fighting inflation.

We see the Fed Funds rate reaching 2.5-2.75% by year end. For some perspective, we must remember that the last time inflation was as high as it is today, the 10-year Treasury yield was at 14%.

Inflation fears now dominate the market narrative and interest rates are going higher. It is the traditionally “safe” asset classes, such as cash and bonds, that suffer the most damage in periods of high inflation (see John Sleeting’s article in this Thought Leadership publication).

Equities, on-the-other-hand, have historically offered the best inflation protection as companies are able to maintain profitability by passing rising input and labor costs along to consumers in the form of higher prices.

The first quarter of 2022 was a tough time for investors, even as equities rallied in March. Total returns for U.S. stocks ranged from a decline of 3.72% for the Dow Jones Industrial Average to 8.68% for the NASDAQ. Click HERE for full index return data. Clearly, it has been a bad year so far for stocks, but is has been no picnic for the long end of the Treasury market with prices falling more than 8%.

In what many believe to be a sign a recession is approaching, the yield curve recently inverted (the 10-year Treasury rate traded below the 2-year Treasury rate). While this can trigger additional pressure on the markets, it does not necessarily mean a recession is just round the corner. In fact, it usually takes about 18 months following an inversion for stocks to peak. Remarkably, the S&P 500 Index has historically averaged a 19.1% gain between the point of inversion and peak prices (Stansberry Research).

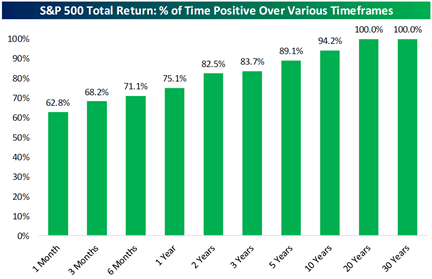

An investors commitment to long planning horizons matching their needs remains one of the primary determinants of success. While short-term setbacks are always unpleasant, as shown above, the longer your holding period with equities, the more likely you are to show positive returns. The consistency of positive returns increases quite dramatically with longer term perspective.

Over the S&P 500’s entire history, the total return for index has been positive over all rolling two-year periods 82.5% of the time and it jumps to 94.2% over all 10-year periods. While not shown in the chart, the first point on the annual curve where 100% of the rolling periods have been positive is 16 years. This simply means all rolling 16-year periods in the S&P 500's history have been positive (BESPOKE).

Our view of the U.S. economy remains constructive. We are optimistic on the U.S. economy even as market conditions have become more difficult. Above average levels of pent-up demand and liquidity will boost economic activity in the months and years ahead. We expect this alone will mitigate recession risk for the foreseeable future.

Should you have any questions or concerns, please reach out to us. Sometimes a candid conversation can provide us with the perspectives we need to get through the challenges we face.

John E. Chapman, CEO – CIS

April 2022