Our Next Economic Tailwind – Demographics

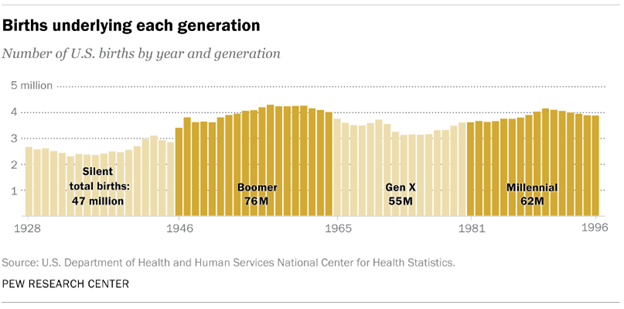

/As of 2019, the Millennial generation (those born between 1981 and 1996) officially surpassed the Baby Boomers as the largest living population group in the United States (Source: Pew Research). While much of our commentary and attention focuses on current trends and data, it can be easy to be so focused on the here and now that larger structural trends, like demographic trends, go unnoticed. While these current trends and data are critical for making tactical investment decisions, it is also important not to miss the forest for the trees given the time horizons our clients are typically working with.

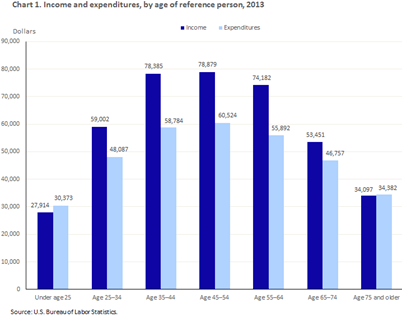

Historically, demographic trends have had a major impact on economic growth rates around the world. The concept is quite simple, as the average person ages their spending increases until it peaks in their mid-50’s. It is during this age range where households are typically formed, children are born, houses are purchased and furnished, and businesses are started.

Populations ebb and flow based on birth rates and immigration levels. As the percentage of a country’s population in the 30-50 age range grows so too does the economic impact of their spending, which correlates with faster their economic growth. This is especially true in countries like the United States, where roughly two thirds of the economy is consumption based and is exactly the scenario we find ourselves in for the coming decade.

As we can see in the chart below, the last time we had a major demographic boost like this was when the Baby Boomer generation was reaching prime spending years in the 1990s. Conversely, the relatively light period from 1965-1980 (Gen X) correlated with the relatively lighter growth period of the mid 2000’s to early 2020’s. Granted, the economy is massively complicated and there are many other factors at work during these time frames, yet this was certainly one of them.

The average American Millennial is now 26.5 years old, while the oldest are now in their early 40s. There are an estimated 73 million Millennials, currently making up 21.2% of the U.S. population, but this cohort is expected to continue growing until peaking in the late 2030’s due to the majority of immigrants falling into this age cohort (SOURCE: Pew Research, U.S. Census Bureau). Further, as you look at birthrates by year, you can see that the Millennial generation is somewhat back-end loaded, meaning we are just beginning to hit the ramp up stage of this cohort. This isn’t only true here in the U.S. but worldwide. While some countries, like China and Japan, have just the opposite age breakdown, the Millennial population in aggregate is the largest in world history.

Several studies have shown Millennials to be the best educated generation in U.S. history, and to have higher rates of employment (despite popular belief) and higher earnings than their predecessors at similar ages. However, the average Millennial is less wealthy than prior generations due largely to higher average debt levels (student loans). It is also no secret, perhaps relating to the prior point and the fact that longer life expectancies are removing the urgency felt in prior generations, that Millennials are largely delaying major life events like marriage, home purchases, children, etc. compared to prior generations.

Only time will tell how these trends play out into the future. Yet we are already starting to see Millennial demand for homes growing rapidly. This trend, and spending more broadly, is likely to accelerate as the Millennial generation continues to age. It must also not be forgotten that a massive wealth transfer, the likes of which the world has never seen, has already begun as the wealth grown by the Baby Boomer generation is transitioned to their heirs, thereby helping to offset the wealth gap over time.

There are a great many contributing factors when it comes to economic growth. Interest rate policy, legislative policies, international trade and geopolitics are but the tip of the economic iceberg. While strong demographics like the U.S. has for the coming decade is expected to act as a tailwind to economic growth, it does not ensure a smooth ride. Given the litany of issues now facing the world’s economies, this is one bright spot that we will be glad to have on our side.