Economic Growth, Booming Profits, and Loose Monetary Policy

/On Black Friday equity markets around the world reacted sharply to news of a COVID-19 variant identified as 'omicron'. It will take weeks to fully understand the severity of this new variant, but the sell-off was immediate as investors feared possible new restrictions and lockdowns.

Debate over the efficacy of existing COVID vaccines for the new variant has only fueled investor nervousness and elevated volatility persisted as November came to an end. As has been the case throughout the pandemic, market participants appear to be taking a “sell first, ask questions later” approach to the news of omicron. Whatever the news cycle brings in the weeks ahead, this pandemic has generally taught us that panic is a poor investment strategy.

The world economy has been rebounding strongly, especially the U.S., as pandemic restrictions have loosened, and life has been slowly starting to look a bit more normal. Even with prior variants, such as the delta variant, the U.S. economy has done quite well this year. Leading indicators rose sharply in October suggesting the current economic expansion will continue into 2022, and may even gain some momentum in the final months of this year.

Retail sales, once again, beat consensus expectations in October, rising 1.7% for the month, which included a rise in consumer prices of 0.9%. Sales are now up over 16% from a year ago and are 21% higher than in February 2020, just before COVID wreaked havoc on the U.S. economy.

We believe consumer activity received a significant, but somewhat artificial, boost from government stimulus checks and extended unemployment benefits in response to the COVID pandemic. Retail sales have been trending much higher than they would have had COVID never happened. This contrasts with the overall level of economic activity (real GDP) which is still running lower than it would have been in the absence of COVID.

Consumers have become very concerned over rising prices over the past couple of months and rightfully so. Recent data on inflation indicates that prices have been going up at a pace not seen in nearly four decades. Consumer prices rose 0.9% in October and are up 6.2% in the last twelve months. We now expect the rate of inflation, as measured by the CPI, will approach 6.5% in 2021, the highest inflation since 1982.

Inflation is generally defined as too many dollars chasing too few goods, which near-perfectly sums up the current situation in the U.S. Going forward the questions will be 1) can consumer demand remain this strong, and 2) will businesses be able to ramp up supply to meet demand. Our view is that demand will remain elevated as supply constraints take time to be resolved.

We correctly predicted a sharp uptick in inflation earlier this year. Various government officials, from the Treasury Secretary to the Federal Reserve Chair, have insisted rising costs would be transitory. Our view has consistently been that inflation is not temporary and now the only question is whether the Fed chooses to act quickly or slowly to combat inflation with tighter monetary policy.

Unfortunately, we believe the Fed is already behind the curve and is not likely to move more decisively until late next year. By then much damage will have already been done and the purchasing power of American’s hard-earned money will continue to erode. The Fed’s inflation forecasts have roughly been between 2.0% and 2.5% - nothing close to what the country is experiencing.

By some estimates, the level of excess savings in bank accounts is sitting at about $4 trillion. We believe it will take several years for the record surge in liquidity (measured by M2 Money Supply) to work its way through the economy. M2 is now 40% higher than where it was before the COVID pandemic began. Accordingly, we see inflation running 4%, or higher, at least through 2024.

All of this will ultimately put downward pressure on future economic growth somewhere down the road. Eventually, the Fed will be forced to tighten monetary policy. While it is too early to worry about the next recession, we must remember that nearly every recession in the past 50 years has been preceded by a sustained tightening of monetary policy which takes the form of high real interest rates and a flat or inverted yield curve.

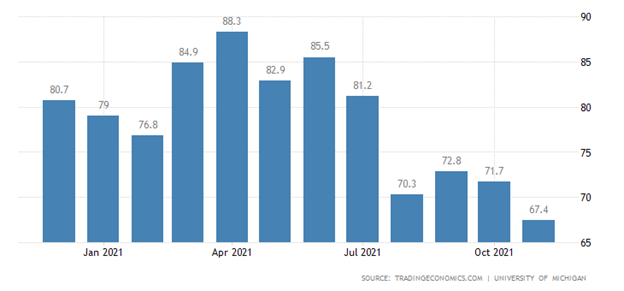

Many investors and the media see the economy in bad shape and getting worse. The University of Michigan’s Survey of Consumers reported that consumers expressed less optimism in the November 2021 survey than any other time in the past decade about prospects for their own finances as well as for the overall economy. The decline was due to a combination of rapidly escalating inflation combined with the absence of federal policies that would effectively redress the inflationary damage to household budgets.

So, with a surge in inflation and slipping confidence, why have the U.S. equity markets been flirting with record highs? This apparent contradiction is best explained by corporate earnings which are up 43% from last year on +18% higher revenues. Almost 80% of companies beat their earnings-per-share estimates in the third quarter of 2021. S&P 500 earnings have reached a new quarterly record, surpassing a record set the previous quarter. Even better, estimates for 2022 earnings have moved higher all year.

The Fed has taken great pains to insist that it won't need to tighten for at least another year or two. This said, the economy is growing, profits are booming, and monetary policy remains loose. We think widespread shutdowns are unlikely in response to omicron or any variant. With this as a backdrop, the downside risk to equities appears to be relatively small as we move into 2022. The current bull market is likely to continue climbing the wall of worry through 2022 and into 2023.

Even as we maintain this constructive outlook, we acknowledge there will be periods of unpleasant volatility as we experienced in September and on Black Friday. This volatility is the price investors pay for above average long-term gains. Having a well-reasoned thesis protects us from kneejerk mistakes and allows us to take advantage of market dips that will most certainly come our way.

Thank you for your continued confidence in Clearwater Capital Partners. Please do not hesitate to reach out to us if you have any concerns or should you wish to discuss our strategies in greater detail.

John E. Chapman

December 2021

PS. If you have not had an opportunity to look at the Clearwater Capital Foundation’s Year in Review report, please do so. An electronic copy is included in this Thought Leadership package for your convenience.