September Private Client Letter

/September 2022 – Private Client Letter

This has been a difficult year for stocks, and it may not get much easier in the near term. September is historically a tough month for equities. Since 1950, the S&P 500 Index has averaged a 0.54% decline in September, the worst of all 12 months.

This isn’t a very uplifting message but consider that October is right around the corner and that month kicks off a string of some of the best months of the year for stocks. In fact, during midterm election years, the best three months of the year have been October, November, December.

Inflation, and the Federal Reserve’s policies to combat it, remain the dominant economic and market issue heading into the final four month of 2022. While the August jobs report provided some encouraging news in the form of slightly less wage pressure, more evidence of falling inflation will take time to materialize.

The U.S. unemployment rate rose to 3.7 percent in August of 2022, the highest since February and above market expectations of 3.5 percent. This “softness” in the labor market was exactly what the Federal Reserve was hoping to see. The labor force participation rate increased to a five-month high of 62.4 percent in August from 62.1 percent in July, however the average weekly hours per worker declined to 34.5 in August from 34.6 in July, tying the lowest level in the last couple of years. Even though more people were working in August, the total number of hours worked declined by 0.1% for the month.

United States Unemployment Rate

The Fed will likely stay the course with further rate hikes over the near term. That said, the slight rise in the ISM services index to 56.9 in August, from 56.7, suggests the economy has not entered a recession just yet. We continue to believe GDP growth in the U.S. will be positive in the second half of the year with the third quarter running at an annualized rate of about 3%.

Our view has been that market participants had gotten ahead of themselves in betting on a less hawkish U.S. central bank. Fed chair Powell and many other Fed officials stressed, almost every chance they got, their intentions to keep lifting interest rates until they see sustained signs of cooling prices.

When inflationary pressures first began to appear around a year ago, we did not accept the notion that the problem would be “transitory”. Nor did we embrace the view in July, as some inflationary data began to moderate, that the Fed was prepared to “pivot” away from the further tightening of monetary policy.

This said, we believe that peak inflation is now behind us and inflation measures will begin to moderate over the balance of the year.

The recent ISM Prices Paid Index measures those respondents reporting higher input prices for manufacturing. Last March that percentage stood at 87 and has since fallen to 52. With further signs that supply chain pressures continue to abate, consumers can reasonably expect some relief in prices in the coming months. Still, we believe it will be several years before the pace of inflation settles all the way back to more manageable levels.

As we enter September, stocks are still up from their June lows. However, the last few weeks cut those gains by more than half. The good news for equity markets is the improving data on inflation and a growing perception that the Fed may not have to tighten as much as feared. Also, the fourth quarter of a year is historically favorable for equity prices and, if history is any guide, midterm elections may provide an added late-year boost.

Traditionally, the rule of thumb in politics is that after Labor Day voters start to seriously turn their attention to November elections. In the Senate, political strategists are focused on 10 seats (5 Republican and 5 Democratic) that will likely determine control of the evenly divided chamber. Despite the two recent wins by Democrats in the special House elections, they still have long odds at keeping control of the lower chamber.

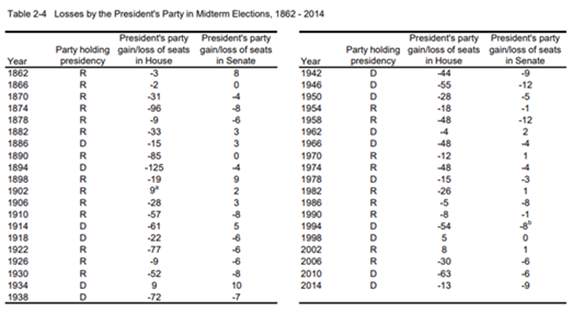

Below is an interesting chart prepared by the Brookings Institute. It shows how midterm elections have gone from the Civil War through 2014, and the pattern is hard to miss. The party that controls the White House lost seats in the House in all but four elections.

Lastly, we continue to be very encouraged by the resiliency of corporate earnings in the U.S. Given the many challenges corporate America has faced in 2022, the second quarter earnings season was an unambiguous success. With a few companies yet to report, it now looks like earnings will end up 6.2%, according to FactSet estimates.

Revenue grew a very solid 14% year-over-year and a solid 76% of the S&P 500 companies beat their earnings targets. Both measures easily beat analyst expectations. While our conservative estimate for 2022 S&P 500 earnings remains at $220, we believe it is entirely possible that profits will surprise to the upside through the balance of the year. If this is the case, it is likely that equity prices (as measured by the S&P 500) could finish the year 10% to 12% higher than they are today.

We will continue to watch all developments and share our insights with you. Please do not hesitate to contact us should you have any questions or concerns. As always, thank you for your continued confidence and trust.

John E. Chapman

September 2022