Financial Health Check Up

/Similar to organizing an annual appointment with your doctor to ensure that you are physically healthy, a regular financial health check-up will help ensure that your financial health is strong.

The benefits of completing a “financial health check-up” are numerous, the most important is determining whether you are well positioned to meet both your short and long-term financial goals. Other important areas to review on a consistent basis include your ability to cover your ongoing cash flow needs and how to protect you and your family financially in case of an emergency.

With the recent increased level of market volatility, reviewing your overall financial situation beyond simply the fluctuating values of your investment portfolios has possibly not been a top priority over the past several months, or may just seem simply overwhelming. To assist you, and simplify a process that can be complicated, we have created a 12-question check-up to help you assess your financial health.

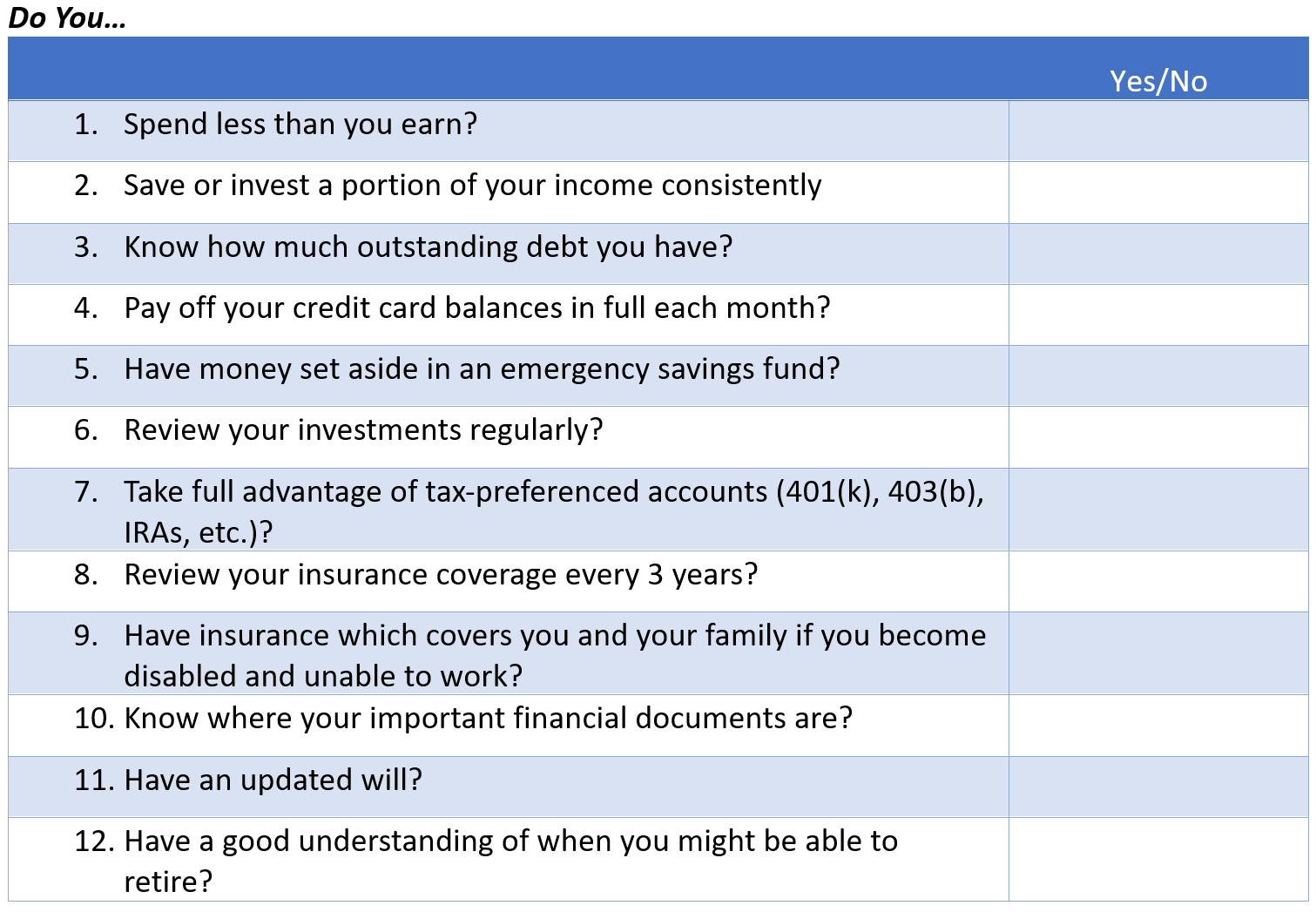

Take a moment to answer the following yes/no questions.

To score: Total the amount of “yes” answers. A score of 10 or above is excellent and a score above 7 is very good. Of course, when considering a “Financial Health Check-up,” is “very good” good enough? What can you do to improve your financial health?

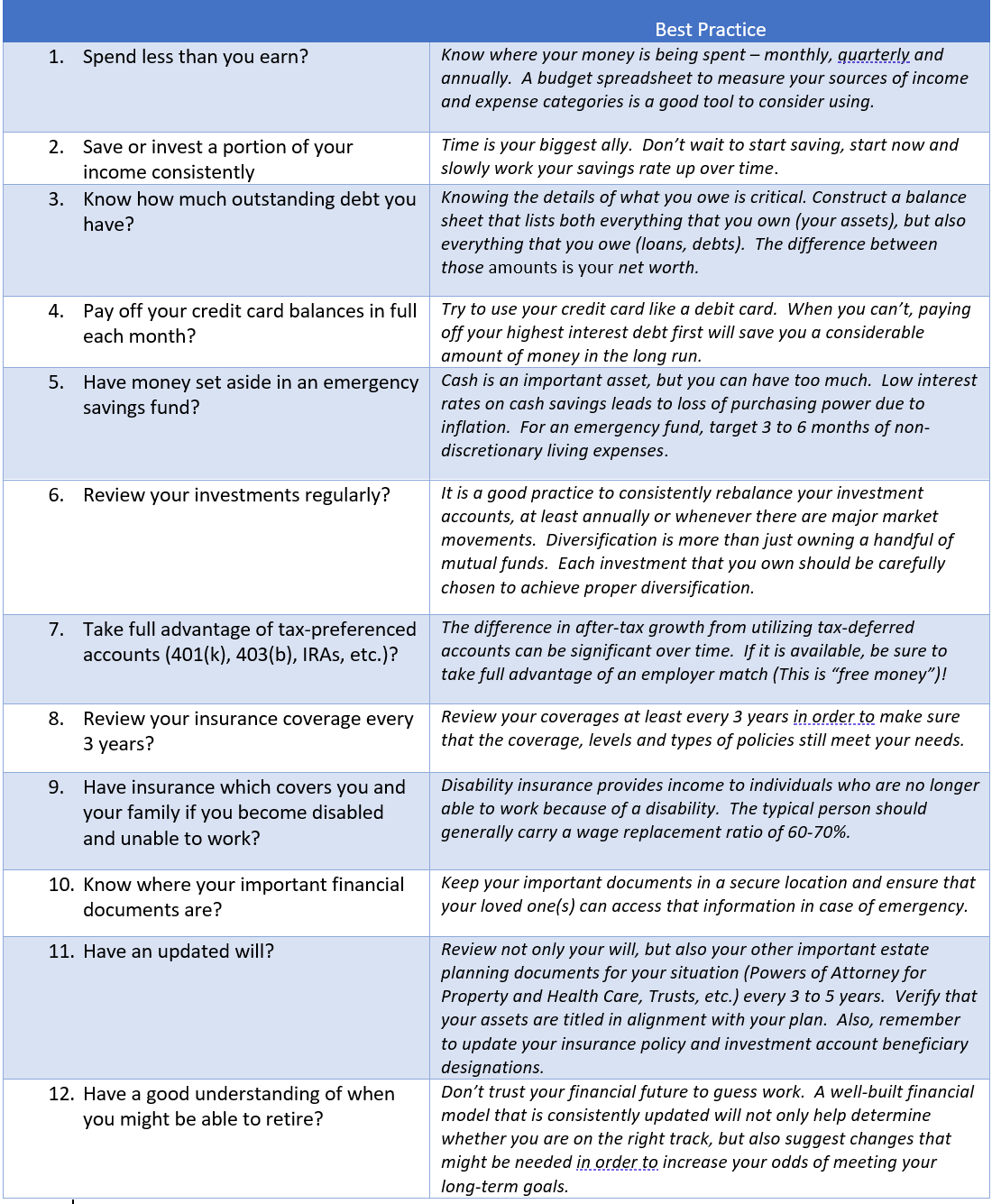

To strengthen your score and increase the number of “yes” answers, here are several best practices and tools to consider.

By reviewing and consistently asking yourself these “financial health-related” questions, you may quickly recognize areas within your financial plan that need attention. Consider some of the best practices, tactics and tools highlighted here in order to help improve your “financial fitness” score in the weeks and months ahead.

The advisory team at Clearwater Capital Partners addresses issues such as these on an ongoing basis for our clients through comprehensive planning discussions as well as financial modeling that we provide. Quite often these discussions will require the expertise of other trusted advisors such as estate planning attorneys and accountants with the goal of meeting a specific planning need.