Beware of Behavioral Biases

/The volatility experienced in 2022 has some investors sitting on the edge of their seats. While the is S&P500 down 14% YTD, it may be even more alarming that we have seen already 2 major drawdowns of >10% in just the first 4 months. Anytime investors experience volatility like this, there is a natural urge to consider a strategy change. Should I go to cash? Should I re think my allocations? These are natural strategy questions because, as humans, we can’t help but combat the urge to “do something.” When going through these mental gymnastics one will encounter, knowingly or not, many behavioral biases. It is helpful to study and to be aware of these various biases in the overall context of behavioral finance to help navigate volatile times.

Behavioral finance is the field of study that looks at investor psychology as it relates to money. It reveals the many pitfalls and fallacies the brain is vulnerable to when dealing with decisions specifically relating to money or investments. It is no secret that people, in general, are not great at investing. Emotions can be powerful and counter productive. Separating one’s feelings from the facts is a high hurdle for many Americans, leading many to do the exact wrong things at the worst times.

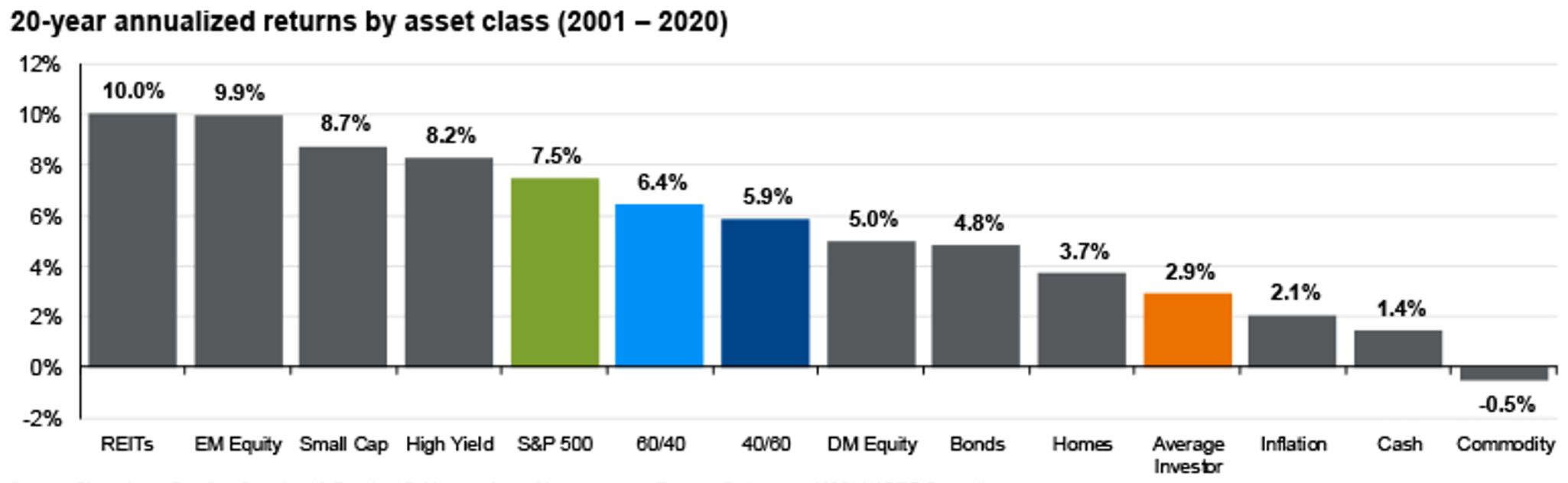

This is the reason that the “average investor” has experienced the weakest returns over the last 20 years when compared to basically any other asset class.

Source JPMorgan

In 2019 I was on the campus of UCLA, partaking in their Behavioral Sciences Executive Education program. The program provided a deep dive into some of the primary behavioral biases (present bias, overconfidence bias, hindsight bias, loss aversion, etc.) Considerable attention was given to historical examples of how these biases interfere with productive decision making.

Fast forward to today and consider of some of the headlines related to the volatility, The Fed, inflation, the War in Ukraine, there has been no certainty of events to contend with. During moments like this, moments of uncertainty and fear, investors often fall victim to terrible decision making.

Some great illustrations of this come from research by Daniel Kahneman & Dan Lavallo in a study called “Timid Choices and Bold Forecasts: A Cognitive Perspective on Risk Taking.” According to their study, when someone says they are “99% sure of something”, they are right only about 70% of the time. Interestingly, entrepreneurs specifically overestimate the likelihood for their idea’s success. In the same study these entrepreneurs were asked what the probability of success for their idea would likely be. On average, 80% of entrepreneurs said their probability of success was greater than 80%. One third of those respondents said success was certain. Five years later the results showed only 33% of the ideas actually succeeded. Humans drastically overestimate their ability to make good decisions, especially during moments of stress or uncertainty.

In moments of volatility, it is also important to avoid the temptation to “time” the market. “I will just sell my stocks at the top of the market, I wait for prices to go back down, and then simply buy at the bottom.” In theory, this would be a tremendous strategy. Unfortunately, the reality is this seldom works as planned.

The difficulty with trying to “time” the market like that is it requires the average investor to be right, twice. In that exact moment of uncertainty, the investor would have to have the wherewithal to sell out of their stocks at the top. They’d then have to turn around and be right a second time and buy back in when the market bottoms. The fallacy of this strategy can be illustrated by studying fund flows during the 2008 financial crisis when many investors tried to employ the “go to cash, invest when its over” strategy. In hindsight, we can identify that the optimal date for an investor to have gotten back into the market would have been on March 9th, 2009 - the S&P 500’s low during the Great Financial Crisis. When looking at ETF flows, it turns out that investors were actually selling, rather than buying, at this time. According to EPFR Global, fund flows unto Bond ETFs actually outpaced equity ETFs by 30:1…

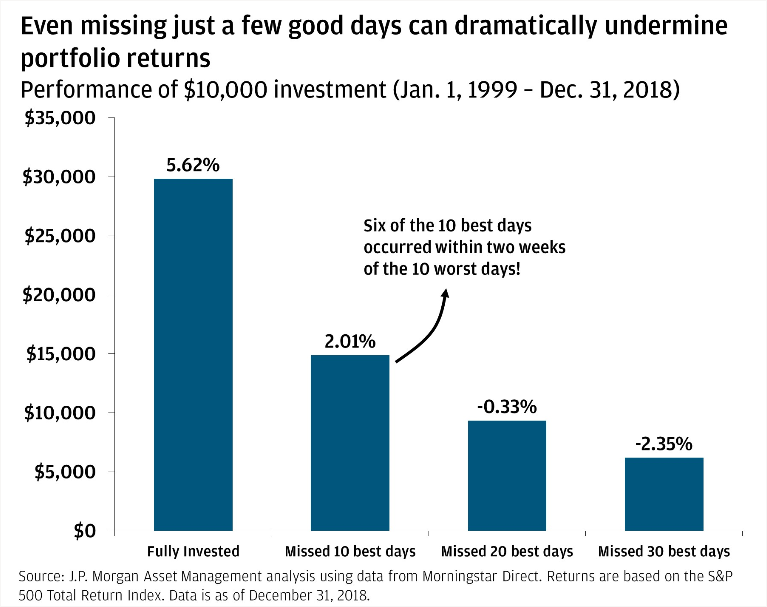

The challenges are exacerbated by the observation that historically, some of the days with the best market returns are within close proximity to the days with the worst market returns. The graphic below illustrates the potential damage one could do to their portfolio strategy by missing just a few of the best days.

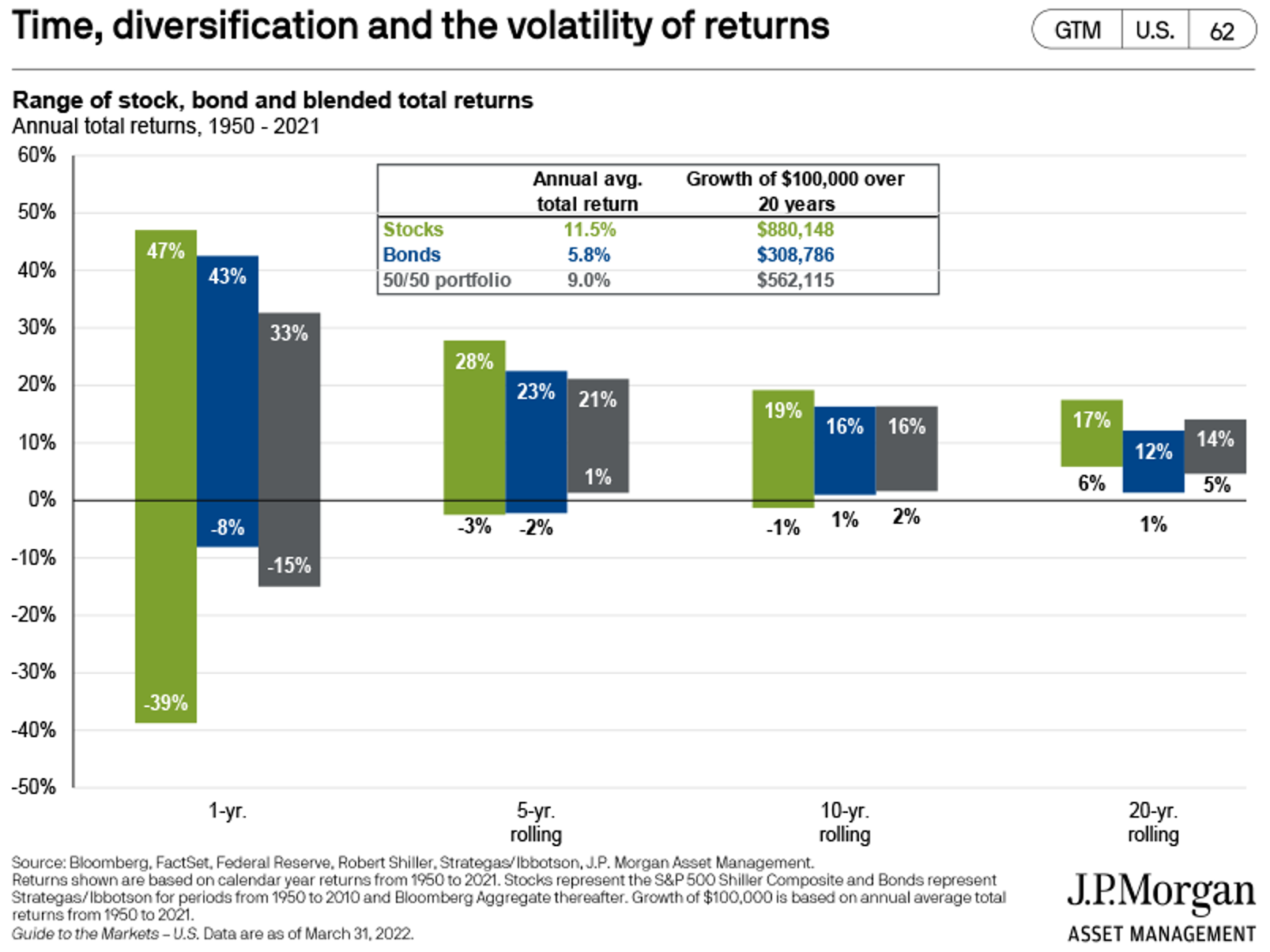

The desire to attempt to sidestep market corrections is understandable, especially when one considers the general lack of volatility that markets have enjoyed for much of the last 10 years. This month is a good reminder that markets are not one directional, and volatility really is the price that is paid for long term returns. Consider the chart below , which shows the range of returns over various time periods.

The important thing for investors to remember during times like this, during times of increased volatility and fear, is to stay calm. Properly constructed portfolios are built to work over time, not all the time. Market corrections are a very normal part of any healthy market cycle. Investors are best served when they stick to the long term plan and avoid letting behavioral biases get in the way.

Stick to the plan, and remember not to let your behavioral biases get the best of you.

-James Chapman