November Private Client Letter

/Election Day Has Finally Arrived

Thankfully, we have come to the end of a particularly contentious political season in which rival campaigns each suggested that the other side will hasten the end of the republic. Today, the swing states will again decide the election outcome. While most attention has been focused on Pennsylvania, other key swing states that matter include Arizona, Nevada, Wisconsin, Michigan, North Carolina, and Georgia.

Investors often believe that national elections will impact capital markets and lead to higher market volatility because political outcomes can significantly influence economic policies, regulations, and broader market conditions. Different political parties usually have different approaches to fiscal policy, taxation, government spending, and regulation. For example, a government favoring lower taxes and deregulation might be seen as more business-friendly, which can boost investor confidence and lead to higher stock prices.

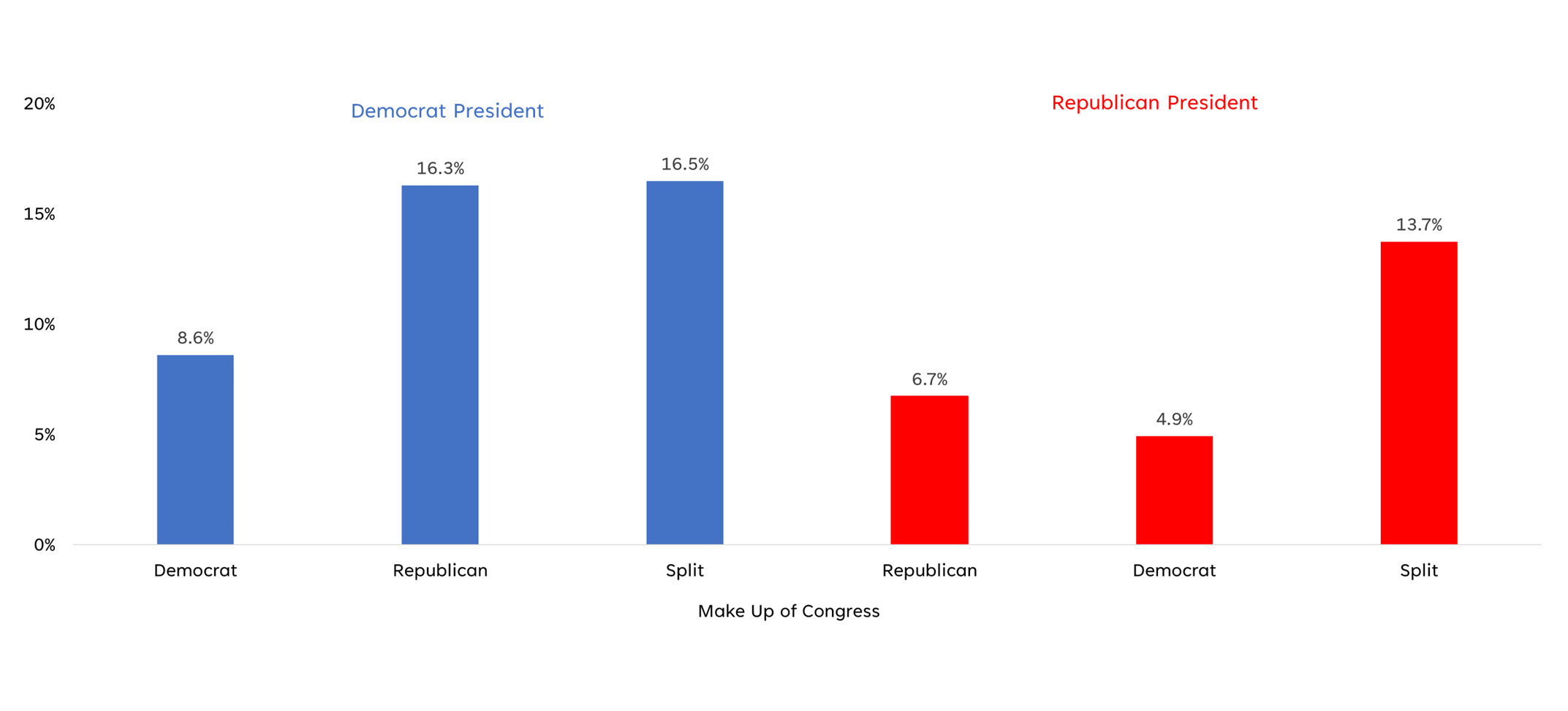

House and Senate races are expected to be closely contested in today’s election. Narrow majorities and divided government appear to be the likely outcome for Congress. Commonly referred to as “gridlock”, this would be a welcome development for many voters across the political spectrum. This tends to lead to more moderate policymaking, which reduces uncertainty and often supports stable economic conditions and better market returns.

Stocks Like the Certainty That a Split Congress’s Gridlock Brings

Average S&P 500 Annual Return (1950 - 2024 YTD)

Source: LPL Research, Bloomberg. Data are from 1950–2021.

Markets generally dislike uncertainty, and elections can be a major source of it. This time around however, equity prices are historically high relative to corporate earnings and investors appear relatively tranquil about this year’s election. They also seem strangely unconcerned about America’s massive and growing federal debt burden. As confusing as this might be to some, investors appear equally unconcerned about the growing geopolitical hotspots around the world; even as Jamie Dimon, chief executive of JPMorgan Chase, continues to warn that conditions are “treacherous and getting worse”.

The good news is that the economy has thus far managed to pull off something that appears to be a soft landing and forecasters are increasingly upbeat about the economy’s prospects, according to The Wall Street Journal’s latest quarterly survey of business and academic economists. Some of the survey responses related to the election are quite interesting.

These same business and academic economists expect the unemployment rate will remain relatively stable over the next twelve months at just over 4%.

We will soon have the opportunity to weigh the election results to assess potential changes that will likely emerge under a new administration. We will be focused on the following:

Changes in Prominent Leadership Positions. Political outcomes can also reshape the composition of institutions like central banks, which influence monetary policy. A new administration might appoint officials who are more or less inclined to support interest rate cuts or hikes, directly impacting bond and equity markets.

International Relations and Trade. Elections can change a country's posture on trade policies, tariffs, and international relations. Outcomes that lead to a more protectionist government could have negative implications for global trade and multinational companies, while a more open trade policy might be viewed favorably by the markets.

Sector-Specific Movements. The impact of election results can vary by sector. For example, if a new government supports clean energy, renewable energy stocks might rise, while traditional fossil fuel companies could face declines. Similarly, the healthcare sector may react differently depending on the expected healthcare policies of the elected government.

Market Sentiment and Investor Behavior. Investor psychology plays a significant role in how markets react to elections. If investors expect favorable policies from a new government, markets may respond positively. Conversely, if the market expects stricter regulations or higher taxes from the new government, stock prices might decline, even if the actual impact on fundamentals is less pronounced.

Studies show that markets often perform better in the months following U.S. presidential elections, regardless of which party wins (Source: Goldman Sachs GIR). This trend, known as the "post-election rally," is attributed to reduced uncertainty once the election outcome is known. However, this pattern is not guaranteed and depends on the specific economic and political context.

The question of whether Republican or Democratic administrations are better for investor returns is a topic of much debate among economists and investors. While conventional wisdom might suggest that Republican administrations, with their focus on lower taxes and less regulation, should be more favorable for investors, historical data tells a more nuanced story.

Market performance during a president's term is most often dictated by the economic conditions they inherit upon taking office. Analyzing stock market returns since the early 20th century, the S&P 500 has historically delivered an average annual return of around 10% under Democratic administrations, compared to about 6-7% under Republican administrations.

The stock market's performance under Presidents Trump and Biden has shown distinct characteristics. During Donald Trump's presidency, S&P 500 delivered a return of about 65% and the Dow Jones Industrial Average was up about 56%. The NASDAQ surged by over 130%. Despite challenges like the trade war with China and the onset of the COVID-19 pandemic, Trump's market gains were notable for a generally strong upward trend.

Under President Joe Biden, the stock market has also demonstrated solid performance, though in different ways. Since his inauguration in January 2021, the S&P 500 has increased by about 51% and the Dow Jones Industrial Average has gained about 37% (up to 10/16/2024). The NASDAQ delivered a gain of about 36%. This positive market movement has been driven by factors like economic recovery efforts post-pandemic and significant fiscal stimulus measures, which have boosted investor confidence.

While Trump saw stronger market returns, Biden also managed to produce double digit annual gains. Both administrations have delivered notable stock market performance, shaped by economic conditions, policies, and global events that influenced investor sentiment during their respective times in office.

Regardless of today’s election outcomes, it is important to note that the strongest stock market performances, whether by year or term, do not consistently align with the party in power. This highlights that economic conditions and external events often play a more significant role in market outcomes than political leadership alone.

One of the key insights we often emphasize is that maintaining a consistent investment strategy, regardless of which party controls the White House, is far more effective than staying on the sidelines due to political preferences. As illustrated in the analysis below, stepping out of the market for extended periods based on political concerns can significantly reduce the long-term gains that a fully invested, diversified portfolio would otherwise achieve.

Only Investing When One Party is in Office is Not a Winning Strategy

Hypothetical Return of $10,000 Invested in 12/31/1949

Source: LPL Research, Bloomberg 06/24/24

In this cycle, we are seeing traditional differences in policy preferences from each party. The Democrats appear to favor robust government spending on infrastructure, healthcare, and social programs, which can stimulate economic growth. They also are showing support for consumer protection and financial regulations, which some investors view as market constraints but can lead to longer-term stability.

The Republicans are again focused on reducing taxes, deregulating industries, and promoting free-market principles. They also want to incentivize investment in the economy, with the expectation that this will lead to job creation and higher productivity. These policies can be immediately favorable to businesses and lead to short-term market gains. However, excessive deregulation or income inequality concerns can pose risks over the longer term.

The overall stance of fiscal policy might be similar under Trump and Harris, but the two offer starkly contrasting visions in terms of taxes and spending. Trump has pledged to fund tax cuts with revenues from import tariffs, whereas Harris has pledged to raise taxes on firms and high earners in order to fund social spending increases.

A Resilient Economy – So Far

For much of the past year, the strength of the economy has felt like a “jump ball,” with different indicators sending mixed signals. I initially believed that a mild recession was more likely, but that assessment has been proven incorrect so far. While I’d like to adopt a more optimistic perspective, there are still significant challenges that justify a cautious approach.

As 2024 draws to a close, the world is confronted with three interrelated, transformational events, each carrying uncertain outcomes: a highly charged U.S. presidential election, an intensifying war in the Middle East, and the continuing conflict in Ukraine. It’s understandable to feel hesitant in light of these complicated issues.

While the “soft landing” narrative remains entirely possible, several conditions must materialize before we adopt the soft-landing scenario as our base case. First, would be a series of interest rate cuts that take the pressure off the economy. Unfortunately, the remnants of inflation still linger, and there are significant risks that an overly aggressive approach to cuts could lead to an increase in the M2 money supply, potentially triggering a resurgence of inflation. This, of course, is contingent on inflation continuing to move down to the Fed’s target levels.

Second, we would need to see a convincing recovery in leading indicators. Some indicators, such as consumer spending and GDP growth, have shown strength. However, other indicators, like manufacturing new orders and the Leading Economic Index, have weakened. Overall, the outlook for the U.S. economy in 2024 remains uncertain. Economic activity remains uneven and vulnerable to a downturn.

Third, labor markets must avoid significant deterioration. Employment trends in 2024 have been characterized by slowing job growth. This downward trend weakened considerably in October with nonfarm payrolls growing by a meager 12,000, far weaker than the consensus expected 100,000. Excluding 2020, the first year of COVID, the October jobs report reflected the smallest gain in jobs for any month since early 2019. Making matters worse, revisions to prior reports reduced nonfarm payrolls by 112,000 for August and September.

In August, the Labor Department announced that the U.S. economy added 818,000 fewer jobs from April 2023 through March this year than were originally reported. This effectively means that job growth averaged 174,000 per month in the year that ended in March — a drop of 68,000 per month from the 242,000 that were initially reported.

And finally, productivity growth must continue to advance. A decidedly positive component of the current economic cycle has been productivity rising 2.7% over the past year, well above the 1.5% average from 2005–2019. With persistent productivity gains, firms can increase output with fewer resources and avoid passing higher costs onto consumers, relieving pressure from inflation and labor markets (Source: Blackstone 10-31-2024).

Conclusion

The S&P 500 just completed what has historically been its weakest six-month period of the year (remember the phrase Sell in May and Go Away?). Remarkably, equities rallied 13.3% from May through October posting their best performance in this period since 2009 and the seventh best performance during that six-month span in the post-World War II period!

The stock market has a reasonably good track record of predicting the presidential election result. The S&P 500 return in the three months leading up to the election has correlated with the incumbent party winning 80% of the time since 1928 (the incumbent party wins if stocks are up and is defeated if stocks are down). Based on this metric Vice President Harris, as the incumbent candidate, would win. The current election cycle has been anything but normal, however, as evidenced by assassination attempts on former President Trump and President Biden stepping down as the Democratic nominee.

Gallup surveys of the American population show extremely high enthusiasm for both parties, with Republicans the most enthusiastic since the 2012 election and Democrats at record levels across either party since at least 2000. In other words, both parties are animated and ready to vote.

It is worth noting that there is a slim chance no one wins the electoral college. If Harris were to win all the Rust Belt swing states, then the best Trump could hope for is to tie by winning all the remaining battleground states and sweeping Nebraska (which splits its electoral votes). At that point the winner would be picked by the House of Representatives where each state delegation would cast one vote. Let’s hope this does not happen!!!

The truth is both Kamala Harris and Donald Trump have proposed some policies that would likely not be good for the stock market, but what candidates say on the campaign trail and what they do in office are usually not the same. Donald Trump was President for four years, and the stock market did just fine, while Kamala Harris has been Vice President for four years, and the market has done just fine as well.

As strange as things have been lately, we can’t rule out that it could get crazier in the days and weeks ahead. Based on the polls, half the country will be pretty unhappy in the coming days.

As always, thank you for your continued confidence in our abilities to help you navigate the many questions associated with growing and protecting your wealth. Rest assured; whatever may be coming our way, we will figure it out.

John E. Chapman

Chief Executive Officer

Chief Investment Strategist