Special Housing Market Update

/While the red-hot housing market has certainly tempered, we haven’t seen the bubble burst.. yet.

Mortgage Rates: Digging into June’s housing market data it’s evident interest rate hikes are having an impact. Nationally, home buying became 15% more expensive in the second quarter of 2022. Qualifying income for the median-priced home increased from $90,000 to $104,000. While 30-year fixed mortgage rates are averaging close to 6%, keep in mind this is still historically low.

Supply: Based on the US Census report, new residential sales were down 5.9% year over year in May. The supply reported at the end of May 2022 on new homes indicated a 7.7 month inventory at the current sales rate. Inventory of existing homes on the market also increased, inching up from 2.5 months to 2.6 months year over year. The existing homes number includes all owned and occupied homes marked as “active” on the market. Pending home sales, which also crept higher in May, are included in “active” listings. That may sound like a lot of new houses sitting around waiting on buyers but according to realtor.com the inventory of active listings is down 34.1% compared to June 2020 and down 53.2% compared to June 2019.

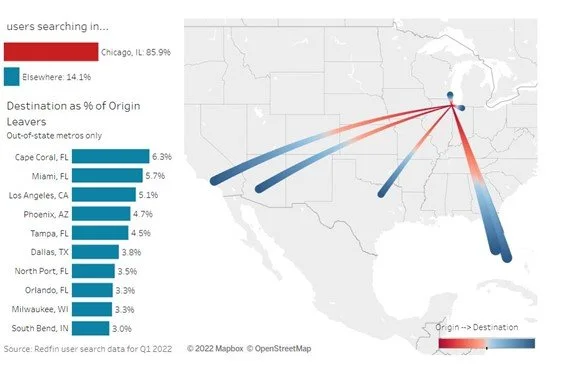

Demand: There’s still plenty of home buyers looking to make a purchase. With expectations of future rate hikes home buyers are looking to lock in existing mortgage rates as soon as possible. There also continues to be a growing wave of housing migration across the country. During the pandemic many made a permanent work-from-home relocation to lower cost-of-living communities. Online brokerage site Redfin analyzes users’ search histories likely to precede an actual relocation. Looking at Q1 2022 data, apparently many Chicagoans are also considering a move to warmer climates.

Home Prices: Analysts agree that homes have become overvalued since the beginning of the pandemic. The Moody’s Analytics map below shows prices relative to expectations for the first quarter of 2022. Among the largest 392 housing markets in the US, 96% have reported home prices that are considered overvalue relative to what their local incomes can support.

Crash or Correction: Extreme growth in housing costs, record-low mortgage rates, and a shortage in supply are all contributing factors for this most recent US housing boom. While some regional markets will certainly be impacted more than others, a slowdown in activity and drop in home prices shouldn’t be a surprise to anyone. Indications are pointing more toward a correction than a nationwide bursting of the housing bubble. Unlike the 2008 housing crash, there isn’t an expectation of a foreclosure crisis, largely due to changes in mortgage lending regulation. From the Federal Reserve’s perspective, the economic impact of higher mortgage rates will effectively cool down the overheated market without setting us up for a complete burst of the housing bubble.

Sources: National Association of Realtors(NAR), US Census Bureau, Economic Indicators Division Association, Moody’s Analytics