Navigating Social Security: A Case Study Assessing Options for Couples

/Making informed decisions about when to claim Social Security benefits is crucial for couples to maximize their retirement income. The optimal claiming strategy depends on various factors, including each spouse's earned benefit, ages, and their ability to invest excess Social Security income. This case study explores three scenarios to show how and when the math changes on benefit maximization.

Case Study 1:

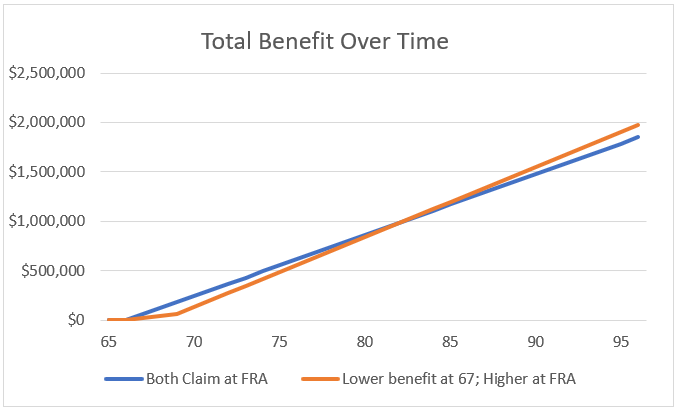

In this scenario, we examine a single-income household with the following details::

Ages: Both 67, Full Retirement Age (FRA)

Monthly Benefit Amount: Him - $3,423 at FRA, $4,206 at 70. Her - $500 at FRA, $615 at 70

Options assessed: Both claiming at age 67 (blue line) vs the lower earner claiming at 67 and higher earner at 70 (orange line). Note that since the lower earner's benefit is below 50% of the higher earner's, they will receive the Spousal Benefit, increasing their income to 50% of the higher earner's.

You may have heard the general school of thought “the breakeven point on delaying Social Security is in your early 80s, so if you expect to live longer than that, you should wait to claim”. This scenario perfectly aligns with that generalization, which is shown by the intersection of the two possible options at age 82.

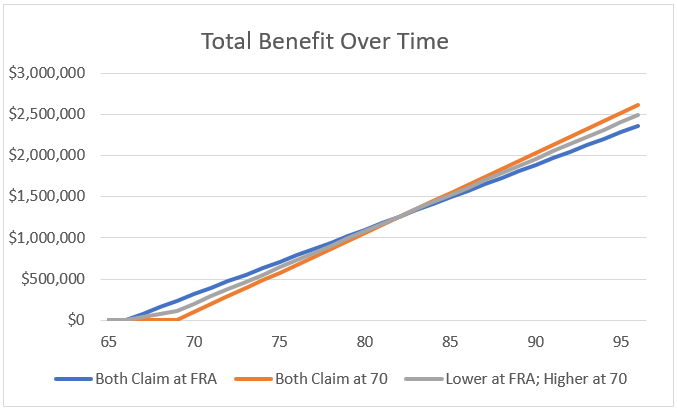

Case Study 2:

This case is very similar to the first scenario, but now we have two high earners, and neither will be eligible for the spousal benefit. All facts are the same except the lower earning spouse now has a benefit of $3,125 at 67, and $3,840 at 70. Because of that change, it is now appropriate to consider having both individuals delay until age 70.

Again, like the first case, the intersection of all three options is at age 82, which agrees with conventional wisdom.

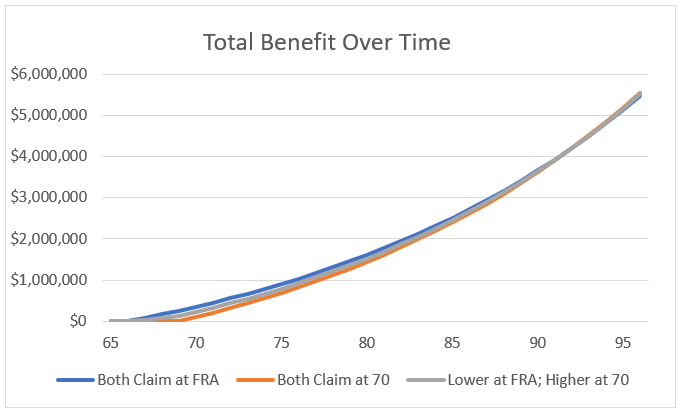

What if, however, this couple has a large nest egg and does not need to spend their benefit and can invest it, earning 5%? The below chart shows the same exact scenario as the previous one but assumes that all proceeds are invested and earn 5%.

Now, the intersection of the three lines is at age 92, indicating that claiming earlier may be the better option if the benefit amount can be invested instead of spent.

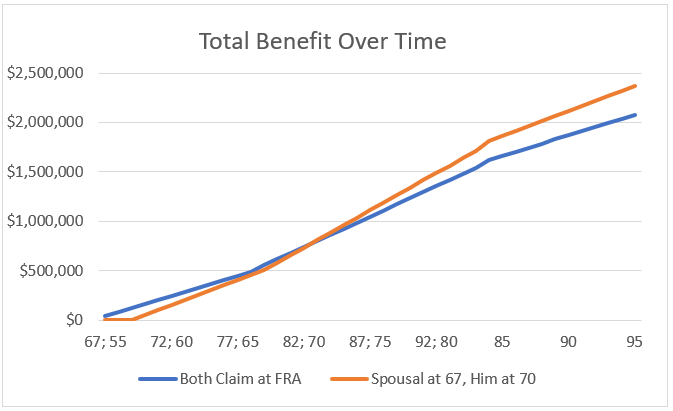

Case Study 3:

As the previous example showed, when factoring in investment returns the general rules of waiting to claim begin to fall apart. Another factor that also changes the calculation is differing spousal ages. In this example, we return to the same facts as Case 1, but change the lower earner’s age to 55, while the higher earner’s remains at 67.

In this scenario, the intersection is when the husband and wife are ages 82 and 70 respectively. Beyond the intersection occurring earlier, when the higher earning spouse passes (at age 95 in this simulation), the lower earning spouse has their benefit increased to match the higher earner’s benefit. This means that if both individuals live to age 95, the younger spouse will receive 12 more years at the increased age 70 benefit.

Conclusion:

Determining the best claiming strategy for Social Security benefits is a nuanced process that requires careful consideration of individual circumstances. While general rules provide a starting point, the case studies highlight the significant impact of several factors. For a personal assessment of your own Social Security benefit strategy contact the Clearwater Capital Partners Planning Team or consult your CCP Advisor.