August Private Client Letter: Economic and Market Narratives are Shifting Quickly

/We are only a few trading days into the month of August and already it feels like an entirely different environment compared to the one we have enjoyed for most of the year. While economic reports have been flashing signs of inflation for many months, the equity markets have spent most of the year ascending to new record highs.

This seemingly odd combination began to shift mid-July as volatility moved higher and the mega cap tech stocks that led this year’s rally began to sell off. Conversely, the prices of stocks considered to be safe haven plays that previously lagged began to rise in this environment with the U.S. Utility Sector rallying by over 4% last week alone.

Over the past months I have observed how economic weakness was building. The Leading Economic Index (LEI) has been pointing to recessionary risks for an extended period, as has the inversion of the yield curve. Added to these gauges are reports of weak money growth, rising inventory levels, deterioration in labor statistics (including multiple monthly payroll revisions), rising unemployment, and most recently U.S. manufacturing data falling to its lowest reading this year. Not surprisingly, consumer sentiment has begun to sour as workers are feeling less job security along with the ongoing pressures of rising consumer prices.

In my June Private Client Letter, I commented:

“We began 2024 by signaling a cautious tone. Our Outlook 2024 report (published in January) concluded with the following observation:

“We believe investors should remain constructive in 2024 while being especially attentive to the unique risk patterns present in our economy and around the globe. The potential headwinds we may encounter in the coming year suggest a range of possible outcomes that are wider than we would normally expect.”

We continue to hold this opinion in what is proving to be an interesting year.

Given the recent weakness in economic reports, persistent inflation, and stretched valuations – I can only imagine that the equity markets are at risk of becoming more volatile as the year progresses.”

There is no certain way of knowing if the economy will transition into a recession, or exactly how the capital markets would react should a recession materialize. What follows is a discussion of key economic data points and various observations that should help to frame the challenges ahead.

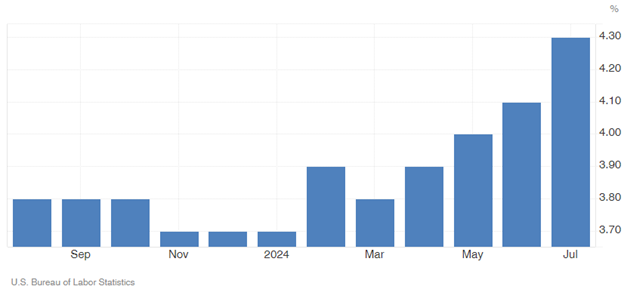

Employment

The labor market was noticeably softer in July and unemployment numbers have been trending higher for most of the past six months. Nonfarm payrolls rose 114,000, lagging the consensus expected 175,000 in the most recent July report, while payroll gains for prior months were revised down by 29,000. Now at 4.3%, unemployment levels are nearing a point where the U.S. may soon find itself in recession. Key details in the report were also concerning. Total hours worked declined 0.3% in July and hourly wages are now up only 3.6% from a year ago, which is barely above inflation.

United States Unemployment Rate

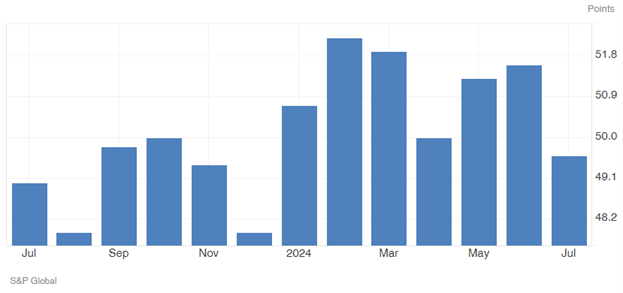

Manufacturing

Another troubling report pointing to deterioration in U.S. economic activity came from the manufacturing sector as the ISM Manufacturing Production index missed consensus expectations once again in July, falling to a seven-month low of 45.9. Given a recent uptick in order cancellations over just the past four months, it is likely we will see continued manufacturing weakness in the second half of 2024.

United States Manufacturing PMI

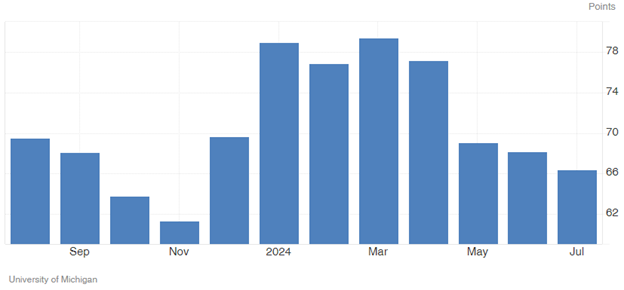

Consumer Sentiment

The University of Michigan consumer sentiment for the U.S. came in at 66.4 in July 2024, marking a new eight month low. Sentiment remains guarded as high prices continue to drag down attitudes, particularly for those with lower incomes.

United States Michigan Consumer Sentiment

The popular, and potentially wishful, narrative of a Fed orchestrated “soft-landing” is unwinding quickly, and recession fears are suddenly spiking. The Fed decided to hold the Fed Funds rate unchanged last week while strongly suggesting that rate cuts would likely be announced at their next regularly scheduled meeting in September. Suddenly the current Fed Funds rate looks wildly out of line with where the 10-year and 2-year Treasury yields are trading.

With the dramatic sell off in global equities, there are already calls for an emergency Fed meeting and an out-of-cycle rate cut of 50 – 75 basis points.

Famed Wall Street expert and Wharton School professor emeritus Jeremy Siegel appeared on CNBC Monday morning to observe that the Fed Funds rate should already be between 3.50% - 4.00% and not at the 5.25% - 5.50% where it sits today. He proclaimed that the Fed’s current position “makes absolutely no sense whatsoever” and that the markets will react badly “if they are going to be as slow on the way down as they were on the way up, which by the way was the first policy error in 50 years.”

According to Bob Doll, Chief Investment Officer at Crossmark Global Investments, historically stock market returns tend to be higher during the period between the final hike in a Fed tightening cycle and the first cut in rates than immediately following the first cut in rates. In fact, Fed policy actions that loosen financial conditions are normally associated with economic and market stress. Mr. Doll observes that, on average, equity prices bottom 23% lower after the first Fed cut in a series of rate cuts.

The selloff on U.S. equity prices Monday morning saw the S&P 500 Index “gap” down at the open by more than 3% marking only the 20th time in history the index experienced such an opening. This followed the largest 3-day drop in Japan’s Nikkei Index in its history (19.5%). If one is searching for some good news in all of this, it might be found in historical comparisons. Going out three months from these large gaps down, the S&P 500 Index has averaged a gain of 11.19% with positive returns 89.5% of the time. The Nikkei has typically bounced back three months later with an average gain of 8.76% roughly 85% of the time (BESPOKE).

However, as is often said on Wall Street, past performance is not a guarantee of future results.

One of the complicating factors impacting the current sell off, and a big reason I highlight the magnitude of the decline in Japanese equities, is something called the carry trade. A carry trade, specifically with respect to the Japanese Yen and the U.S. Dollar, is a situation where an investor borrows a currency (Yen), at very low rates of interest, converts the borrowed currency (Yen) to the U.S. Dollar, and invests these dollars into higher returning assets.

For years the Bank of Japan (BOJ) kept interest rates extremely low. However, recently the BOJ moved to increase interest rates and signaled the potential for more increases ahead. This led to a strengthening of the Yen and the carry trade quickly became much less favorable. As investors and hedge funds hurried to unwind their carry trades, the strength of the Yen only accelerates and the pressure to sell more U.S. assets intensifies.

We will be carefully monitoring this market dynamic in the coming days and weeks.

If the economy is entering a recession, I continue to think the downturn will be short and shallow. The wild card in this expectation comes from an extraordinarily difficult geopolitical fact pattern. The hostilities in the Middle East appear to be on the precipice of spilling over into a serious regional war and the political scenario in the U.S. looms large (and wildly uncertain) with national elections only 92 days away. One can only imagine what may transpire in the days, weeks, and months ahead.

We believe the range of our current investment strategies is balanced, and well positioned for the challenges ahead given a long-term planning horizon. This said, the future is currently as uncertain as any time in recent memory. Understandably, some investors may want to use this time to revisit investment objectives and risk tolerances. If you find yourself wanting to do the same, we can help. Should you be at all uncomfortable with your investment profile during these challenging times, we can discuss alternatives designed to reduce risk exposure overall. If you are unsure about how well your current investment profile aligns to your objectives, we can provide you with the information and advice you may need to make an informed decision regarding what works best for you. Either way, a conversation can go a long way; please do not hesitate to reach out.

Conclusion

Faithful readers of my commentary know that I have been signaling a tone of caution over the past 18 months. Understandably, this has led some to believe my commentary has missed the mark or has simply been wrong. An alternative interpretation may be that I have simply been “early” given the lagged effect higher interest rates have on economic activity. Only time will tell. One thing appears likely, however. The current “soft-landing” narrative accompanied by consensus double-digit earnings growth expectations has faltered in recent weeks. I continue to believe the risks skew to the downside at the present time and that a cautious view is warranted until such time as we have greater clarity over the direction of the economy and geopolitical uncertainties.

As always, thank you for your continued confidence in our abilities to help you navigate the many challenges associated with growing and protecting your wealth.

John E. Chapman

Chief Executive Officer

Chief Investment Strategist