May Private Client Letter -

/Patience and Perspective For Stressful Times

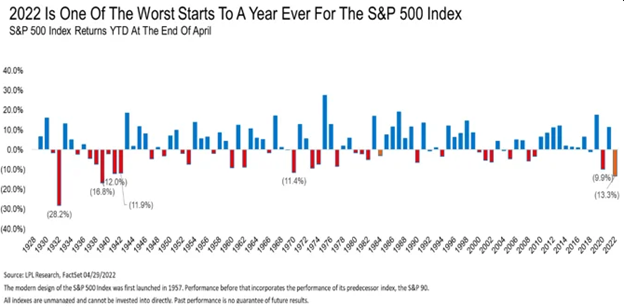

Just when we think things can’t get any worse in this market, another wave of selling rushes in and prices go lower. Making matters worse, every attempt for a rally in the broad indexes has been quickly turned back as stocks grind lower. With four months of 2022 now in the rearview mirror, a lot of damage has been done in equities with declines of about 10% for the Dow Jones Industrial Average (DJIA), 13% for the S&P 500, and 23% for the NASDAQ.

The S&P 500 has now declined at least 1% for four straight weeks while the Nasdaq has been down at least 2.5% for four straight weeks. Since 1971, there have only been four other times where the Nasdaq experienced a similar streak, so this kind of persistent weakness is unusual.

Putting it all together and we see U.S. equities are having their worst start since the S&P 500 was created in 1945. In fact, the NASDAQ has never had a weaker start to a year.

Of course, it is not just stocks that have done poorly. Bonds are off to an awful start as well. Normally we would expect bonds to rally as investors pursue a flight to quality with equities selling off. This has not materialized because the rate of inflation is higher today than at any time in the past 40 years. This has prompted the Fed to tighten monetary policy to combat inflation, and interest rates have been rising.

This unusual combination has already generated significant loss of wealth surpassing $13 trillion in the U.S. Remarkably, former Fed President Bill Dudley declared that more wealth destruction will be necessary for the Fed to achieve the desired response. In Bloomberg Op-ed on April 6th, Dudley said, “One thing is certain: To be effective, [The Fed] will have to inflict more losses on stock and bond investors than it has so far." As a lifelong student of economics and monetary policy, I am having trouble squaring a statement like this with the Fed’s dual mandate of full employment and stable prices.

The Fed’s Federal Open Markets Committee (FOMC) meets this week to finalize their next step to fight inflation with an increase of interest rates. It is widely believed that the Fed will deliver a 50-basis point hike and forward guidance is expected to skew hawkish. Just a few months ago the Fed believed inflation would pass quickly and it is the speed with which they have reversed that opinion that has unnerved markets. This, along with the Ukraine-Russia war and China’s zero-COVID policy, have contributed collectively to a buyer’s strike for stocks.

The uncertainty surrounding Fed policy has understandably devastated investor sentiment so far this year. The AAII survey has moved to record levels of pessimism in recent weeks. To see similar levels of negativity, we must go back to the depts of the global financial crisis in 2008-2009.

Fortunately, we see that those extreme levels of gloom and doom closely marked the exact bottom for equities in that cycle, in March of 2009. Prior to that, we can find similar levels of pessimism in 1990. Both episodes were very good entry prices for stocks over the intermediate and long-term.

With markets under so much pressure, it is helpful to look back at our original expectations for 2022. Our thinking was that the Fed had underestimated the threat of inflation and would soon need to move quickly to tighten policy. We believed the positive catalysts that drove above trend growth over the past two years were not exhausted, and that business profits would continue to grow by at least 10% in 2022. We also observed that the S&P 500 had become dominated by a handful of high-profile stocks that may be vulnerable to high valuations.

While we did not specifically forecast a sharp correction for U.S. equities in the first third of the year, our outlook has proven to be mostly accurate. The Fed’s missteps have been well documented, first quarter corporate earnings are on track to grow at a rate of 5% or more, and those high-profile stocks we expressed concern over have led U.S. equities down with losses exceeding 27%.

We take no comfort in getting these things “right” when our portfolio strategies are losing value, albeit our losses are much more moderate. We do understand however, that markets are driven by sentiment over near-term periods. Sentiment has dropped to historic low levels and the risk/reward characteristics of the equity markets suggest we could be nearing a bottom and an eventual reversal.

Sentiment can, and has, shifted faster than most people can reasonably respond to. When the U.S. equity indexes bottomed in the last market decline(March 2020), all the indexes had fallen by more than -30%. Investors feared the worst at the time because of COVID. But within days, the S&P exited the bear market, the Dow did the same a week later, and finally the NASDAQ three weeks after that. The Dow then soared by more than 97%, the S&P by 114%, and the Nasdaq by 134%.

While we are not predicting such gains in 2022, our view remains constructive. We do not see a recession in 2022 as there has never been one without employment turning down and corporate profits falling. The labor market remains tight with about 1.7 jobs available for every person looking for work. S&P 500 earnings grew by more than 30% in the fourth quarter of 2021 and the current bottom-up projection for calendar year is above 10%.

Our view has been that the Fed will raise rated by 50 basis points at both the May meeting (this week) and again at the next Fed meeting on June 14/15. We believe there is a good chance that inflation is in the process of peaking. The risk to this view is, of course, tied to China lockdowns or another escalation in the Ukraine war. If these problems do not worsen, we feel it is likely that these next two rate hikes could give way to more gradual adjustments in the second half of the year.

Even with the paper losses investors are currently facing, consumer net worth, which is now about $150 trillion, is up 29% versus the fourth quarter 2019. Our view over the past couple of years is that a strong consumer would support continued economic growth for the next couple of years. We believe the fundamentals of the U.S. economy remain constructive and we remain optimistic on the prospects for continued economic growth.

As for the markets, when they are as volatile as they have been over the past four months, it’s impossible to make any sense of the day to day moves. This said, it would be foolish for us, or anyone, to say anything about what investors should expect in the short-term. All we can say is that long-term investors have experienced worse, and the market will eventually turn positive. We do not want to be flippant on this point, it is just that we really believe this.

Is it possible that the markets move lower before stabilizing? In a word, yes. We have recently broken short-term levels of support and we have yet to see the climatic panic selling that often signals market bottoms. Recent momentum would even suggest that further declines are likely. However, it is at times like this that we are reminded of the old Wall Street adage, “the market fools the majority of the people most of the time”. If everyone is rushing to bet against the market, this gives us a degree of confidence that that perhaps we are due for a rebound soon.

We can't control the market, but we can control our decision-making process during challenging periods. With this in mind, we genuinely believe that patience and a long-term perspective are the disciplines that will see us through to brighter days.

Thank you for your continued confidence. Please do not hesitate to contact us should you have any questions or concerns.

John E. Chapman

May 2022