College Planning for High Net Worth Families

/With the kids going back to school, many parents are coming down from the summer fun and realizing they are one year closer to paying for college. College planning and high net worth families typically aren’t two topics combined in the same writing; most families in this category plan to either pay tuition costs from current assets they have already accumulated or to simply pay it out of current cash flow. However, there may be situations where families are paying more than they need to and may be ill advised to forgo the college planning process all together. There are various strategies that all families should take for college planning regardless of the size of their balance sheet. This post will focus on 5 considerations for college planning for HNW families:

Don’t skip the FAFSA Application

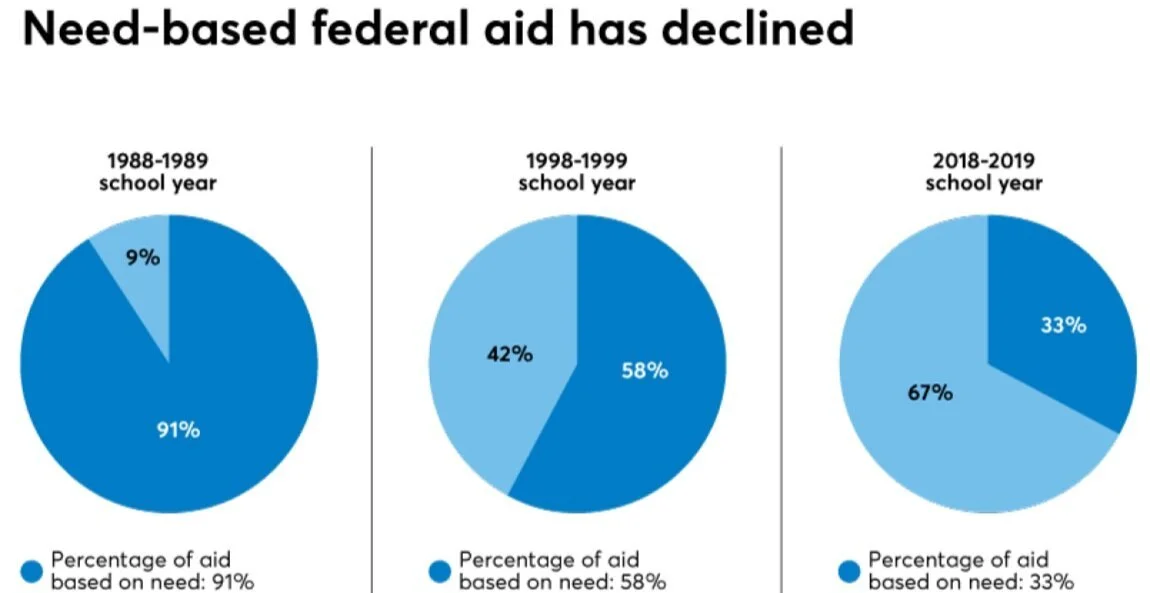

When speaking with a HNW family on this topic I am not surprised to hear that they have skipped filling out the Free Application for Federal Student Aid (FAFSA®). I don’t blame them, as typically they correctly assess that based on income / assets they wouldn’t qualify for needs based assistance. It is important to note however that needs based aid has significantly declined as an overall portion of tuition assistance. Back in the 90’s, needs based aid represented almost all tuition assistance. Today, it only makes up about 1/3rd leaving the rest to merit-based scholarships or grants.

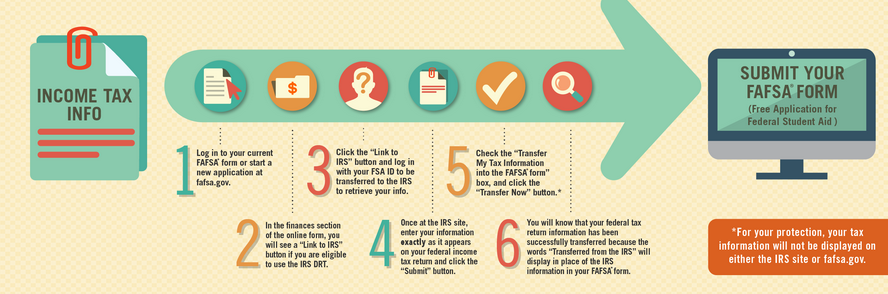

Completing the FAFSA application is a key to gaining access to these merit-based grants. Most universities and institutions require the application to be complete, regardless of the financial picture it may paint, in order to be considered for merit-based programs. It is important to remember that if your child is looking at a private university then they must complete the more detailed CSS financial aid profile. Remember these forms are due by January of the student’s senior year in high school and are necessary to qualify for even merit-based scholarships.

Non-Needs based scholarships

SOURCE: College Board

Merit based scholarships are one of the best ways to offset the cost of tuition for HNW families. Merit based scholarships have no consideration of the balance sheet and rather look at the student’s scholastic and other achievements. Along with the FAFSA application, an early start is a good idea for this process. There are many online services to help source these types of scholarships, one of the best is fastweb.com which maintains a database of more than 1.5 million scholarships.

Consider tax advantaged strategies.

As with many financial planning considerations, recommendations must be made in the context of the entire situation. For families who have their college age children working, maybe part time at school or through a summer internship, we may recommend for them to gift their children appreciated assets. In specific situations you may be able to significantly reduce capital gains taxes by gifting appreciated assets to your children. By taking advantage of gift splitting provisions, a married couple can give a child up to $34,000 (of assets) per year without incurring any gift tax penalty. This has become even more popular as of late for people who may own highly appreciated tech stocks in brokerage accounts.

Be sure to consult your accountant in relation to kiddie tax rules as they may relate to your family situation. Failure to avoid kiddie tax would result in the stock sale being taxed at the trust and estate tax rates, potentially defeating the entire purpose. The kiddie tax Rules would apply if:

The child is under 18 as of the end of the year

They are age 18-24 with earned income that is less than 1/2 of their own support

Are a full-time student under the age of 24 whose earned income did not exceed 1/2 of their own support.

Some parents who own businesses may circumvent kiddie tax rules by employing their children part time, enabling them to earn income to support themselves. They may be random one-off jobs all the way to more full-fledged positions like social media management or website design. Other activities they could perform may be cleaning, file management, booking appointments, or even being a “child model” and using their pictures / video on social media or other marketing related materials.

Example: Mark and Alice are in the 37% federal tax bracket. Their daughter, Sarah, worked a full-time internship over the summer. Her earned income over the summer enabled her to provide more than 1/2 of her support throughout the year. During 2023 Mark and Alice transferred $30,000 in publicly traded stocks to Sarah for her to sell and use the proceeds to pay tuition. Sarah’s federal tax bracket in 2023 is 12% and the cost basis of these gifted stocks is $14,000. Sarah sells these stocks in 2023 and uses the $30,000 to pay her tuition. Sarah’s capital gains tax on the sale of these stocks is $0 because the capital gains tax in 2023 is 0% for those in the 12% tax bracket ($30,000 - $14,000 x 0% capital gains tax = $0). In addition, Mark and Alice will not incur a gift tax on the transfer of these stocks to Sarah because the total fell under the gift tax exemption made by a married couple of $34,000 per year, per each donee.

Another tax advantaged idea is to fund education through your state’s 529 plan. Even if a 529 plan is not something you have utilized up to this point, there are opportunities to pick up tax deductions when paying for college. Here are 2 scenarios:

You plan on paying tuition in cash each year - Rather than writing a check straight to the institution, you can establish a 529 plan and write that check to the 529 plan to fund it. Depending on the state you live in, this could enable you to take a deduction on that amount ($10,000 per individual or $20,000 for married couples in Illinois, for example) and then pay the tuition straight from the 529 plan.

You plan on paying tuition using UTMA or Trust assets - For many reasons, parents may elect to accumulate assets for their children in a UTMA or Trust account (not wanting to be limited to the state program’s investment menu, flexibility in the use of dollars, unsure if college is your child’s path, etc.) If you have accumulated dollars for your children in a UTMA or a trust account, you can still take advantage of the 529 plan for tax deduction purposes upon paying tuition. Similar to the example above, you can fund a year’s tuition out of the UTMA or Trust account and pay it straight to the 529 plan. Depending on the state you live in, you can potentially take a deduction on that amount ($10,000 per individual or $20,000 for married couples in Illinois) and then pay the tuition straight from the 529 plan.

In high tax states, or states where taxes are likely to continue rising, like Illinois, these 529 tax deduction strategies may make sense for many HNW families.

Involve your children in the process

Avoid the temptation to do research / apply on your own for the sake of expediency. If you haven’t before, the financial planning side of college funding is a great opportunity to get your children involved with the conversation. Have them help you with the FAFSA process, have them do their own research on merit-based scholarships. One savvy strategy I have encountered is incentivizing the student to find scholarships by employing a “match” type program. An example of this could be, for every $1 of scholarship they find and receive, the parents fund $0.25 into an investment account for them to draw upon following a successful college graduation. If the student was able to find $10,000, they would have $2,500 funded into an investment account to grow for the next 4 years. There are many ways to be clever and involve the child in the process. This also allows them to be hands-on and gain an understanding of exactly how expensive the education process is, rather than it being something that may be taken for granted.

Avoid potential scams

Unfortunately, no area of planning is immune to potential bad actors attempting to break into the process. College planning is no different and we have seen a number of scams that parents have encountered.

High-Pressure Seminars - Advertising for these types of events might find their way to you by mail, your local Facebook Group, or even from another parent. Beware of these types of events because they typically will follow the same layout. They may begin legitimately by covering the basics of different types of savings accounts but then can switch to scare tactics in an attempt to convince parents and students that working alongside these experts provides their only shot at any financial assistance. These are specially targeted into more expensive zip codes in the hopes that parents may already be weary of their chance of obtaining financial aid.

The Insurance Solution - “When all you have is a hammer, everything begins to look like a nail.” At some point some shrewd individuals in the insurance industry actually figured out how to market insurance products as a college planning investment. The idea is to fund a cash-value life insurance policy to make withdrawals or borrow against policy values to pay for college tuition. What they often fail to mention, however, is that due to the cost of the insurance coverage that comes out of your contributions (in this case your premiums), your actual net contribution to cash values in the policy will be less than what you're paying in. This drag generally makes it difficult for this strategy to outperform a non-insurance option. Another problem with this strategy is that any gain on premiums withdrawn is going to be taxable. Any loan taken against the policy to pay tuition will also have an interest component. In all, there are very minimal situations in which a life insurance product is actually the best solution for college planning.

Getting Ripped Off - For HNW individuals, typically what many of these “programs” are actually offering at the end of the day is help filling out FAFSA. They will do everything they can to convince you or your child of how complex and strenuous of a process it is and offer to provide their “services” and fill out the application for you. These “services” can range anywhere from a couple hundred dollars to multiple thousands of dollars. Please stay away from these types of engagements. After all, the FAFSA application is an application, meaning that it requires personal and detailed data about the applicant that only the applicant knows. This means that you will have to fill out some form that goes to the “professional” that they use to fill out FAFSA for you. I’d recommend cutting out the middleman and conducting the process yourself.

As with all areas of financial planning, the college funding goal can only be solved within the context of the entire financial plan. Avoid one size fits all solutions or “too good to be true” type arrangements. Simpler is typically better in these types of situations, even for HNW families. For HNW families this type of planning is about paying the least amount possible in the most cost / tax efficient way. Please contact me, or your Clearwater Capital Advisor, for help on how best to save for your child’s education.