Political Uncertainty and Bear-Market Rallies

/The primary outcome from the mid-term election results is likely a divided control of government, which is historically viewed as market-friendly overall. There’s still some counting to do in some key races, but it appears as though Republicans will take the House. The latest odds point to a roughly 13-seat House majority, with some possibility it will be narrower. Control of the Senate is down to three Senate seats and may not be finalized until the runoff election in Georgia is completed on December 6th.

A Republican win in the House likely takes any potential tax hikes off the table, including taxes on corporate buybacks, and makes large fiscal spending initiatives unlikely.

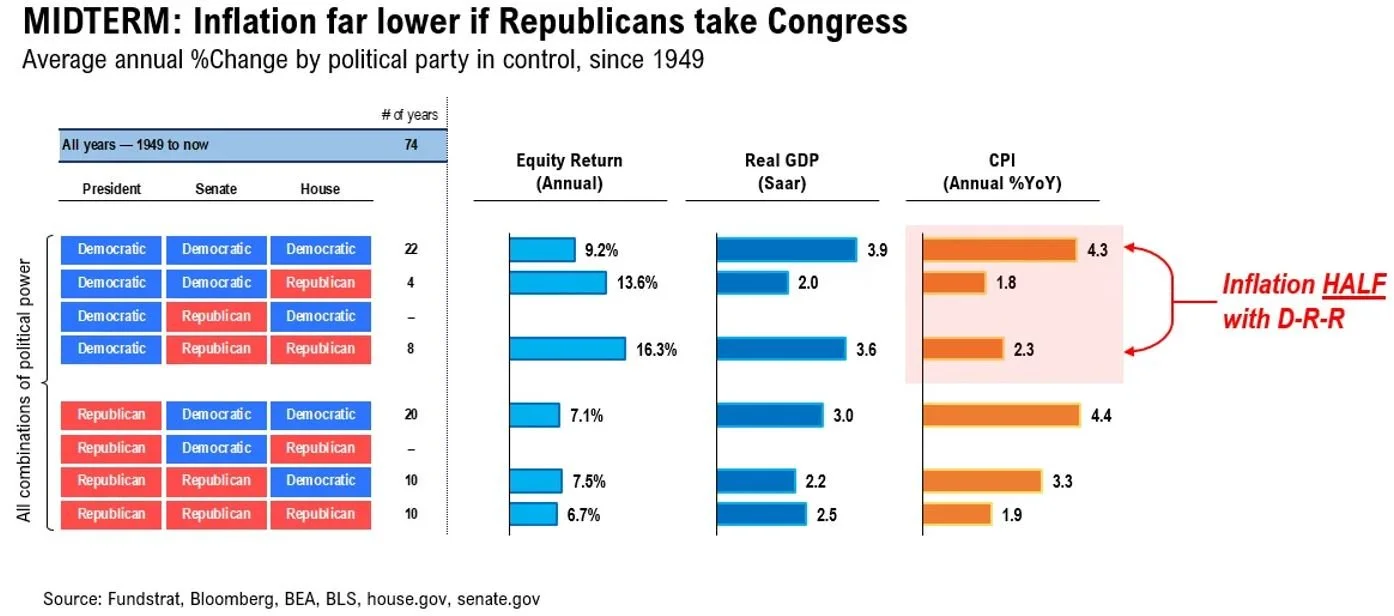

Federal governments with a Republican Congress and Democratic President (D-R-R) have historically produced favorable stock market returns versus governments dominated by a single party. In fact, since 1949 the best equity returns have been when Republicans control both House and Senate. History also shows inflation tends to be lower under a D-R-R split.

However, simple historic comparisons are very problematic in this distorted environment. With inflation still running at 40-year highs and the Federal Reserve committed to their path of rapid monetary tightening, the risks of a recession occurring next year are rising rapidly.

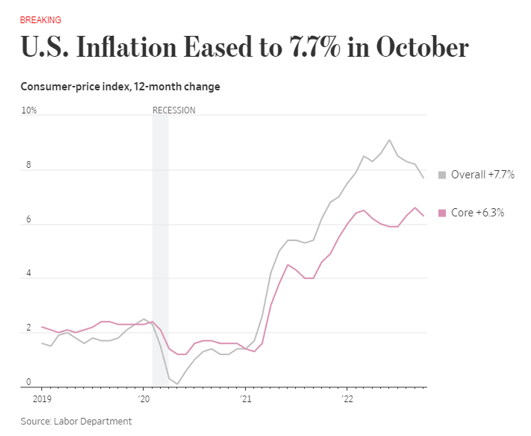

The October CPI number showed the rate of inflation slowing to 7.7%. This represents the first better-than-expected report on inflation in many months and is consistent with our view that inflation peaked last summer. While encouraging, the primary takeaway from the October report is that inflation remains dangerously high, and the Fed is not expected to abandon its hawkish stance. Our view is that the Fed will pursue its tightening cycle into early next year, with the policy rate peaking at 4.50% to 5.00%. The 2-year treasury yield hitting 5-6% is not out of the question.

More important than political gridlock or a slight moderation in inflation is an acceleration to the downside in forward earnings expectations. Analysts continue to lower earnings expectations for both the fourth quarter and 2023, where expectations have declined -3.5% versus just a month ago. With further Fed rate hikes probable, downward trending leading economic indicators, and downgrades to forward earnings estimates, stocks remain vulnerable over the near term. If the U.S. does slip into a recession in early 2023, the stock market will likely have to decline further.

We are expecting several bear-market rallies in stocks over the next 3 to 6 months. Immediately following the October CPI report the Dow Jones Industrial Average surged by over 900 points. However, bear-market rallies often falter with stocks returning to test previous lows. As observed in the November Private Client Letter, “By mid-2023 the worst may be behind us, and risk assets could begin a sustained move higher. Given current financial conditions and other reasonably stable fundamentals, the coming recession will likely be relatively short and shallow.”

We do expect the current bear-market to end in 2023 to be followed by a new bull market that could extend well into 2025, and possibly beyond. Accordingly, we intend to maintain our well-structured portfolios through this period of stress. We believe it is prudent to remain cautious for now and use further market weakness to add steadily to strategies, with an ongoing emphasis on quality and value.

Please contact us with any questions or concerns you might have. Thank you.

John E. Chapman

November 2022