February Private Client Letter

/After a strong 2021, stock market volatility returned in dramatic fashion in January. The S&P 500 has had an intraday trading range of at least 2.25% in January’s final week (Bespoke). The average stock is down a little more than 9% so far in 2022, but stocks with the highest valuations are down closer to 20%. The best performing stocks have been ones with low price to book ratios and high dividend yields.

According to Sam Stovall, chief investment strategist at CFRA, the normal average length of time between declines of 5% or more in the S&P 500 is 104 days, but in 2021, the S&P 500 went for 293 calendar days before falling more than 5% last September. We have had nearly two years of relative calm in the stock market. This can make normal market pullbacks and corrections feel more painful because investors have become somewhat unfamiliar with wild swings.

Source: Bespoke

Not surprisingly, investor sentiment has turned sharply bearish so far in 2022. In fact, a composite reading of sentiment from the AAII and NAAIM surveys shows that sentiment hasn’t been this negative since April of 2020 when the COVID pandemic was just starting. On the bright side, sentiment surveys tend to be contrarian. In prior periods over the last 15 years when net bullishness was in the lowest decile of its historical range, forward returns tended to be better than average (Bespoke).

The January weakness was triggered by several factors. There is increasing fear that the Fed will have to aggressively tighten monetary policy to rein in inflation. While many investors were expecting 2 or 3 rate hikes in 2022, markets are now pricing in roughly 5 rate hikes this year. On top of this, we have the Omicron variant, rising geopolitical tensions, and continued supply chain issues. While these are certainly valid concerns, it appears an excessive amount of fear is being priced into the markets when there are many reasons to be optimistic about 2022.

The U.S. economy is running with solid data and leading economic indicators still quite strong. In fact, monthly changes in leading indicators have been much stronger so far in this expansion than they were in most of the last one. The leading indicators suggest the U.S. economy will continue in expansion mode for the balance of 2022 and possibly longer.

According to analysis from Bespoke, an even better outlook indicator is the ratio of leading indicators to coincident indicators. When leading indicators are outperforming, the economic outlook is bright. When they stall out, the economic backdrop is peaking, and recession risk rises. When they decline, the economy is headed towards or is in recession. As shown in the chart above, the current backdrop is very positive with the ratio rising rapidly.

Corporate earnings have also been solid. According to FactSet, about 33% of the companies in the S&P 500 have reported Q4 2021 earnings with 77% beating estimates by about 4% on average. For full year 2022, analysts are still expecting earnings growth to come in around 9.5%.

One indicator we watch closely is the yield spread between high yield bonds and Treasury bonds. When spreads are falling or low, equities are unlikely to suffer major drawdowns beyond normal pullbacks or corrections. Over the past year spreads have narrowed to the tightest levels since prior to the global financial crisis. While the recent bout of equity volatility has seen a widening of high yield spreads, this indicator remains well below its 52-week high. Compared to other equity market corrections over the past 10 years, high yield spreads are still quite tight and do not portend an extended period of equity weakness.

Looking at the 10-day number of stocks advancing versus those declining, equity markets are now deeply oversold. Historically, oversold extremes such as we are currently seeing do not last long, so we are expecting equity markets will stabilize soon.

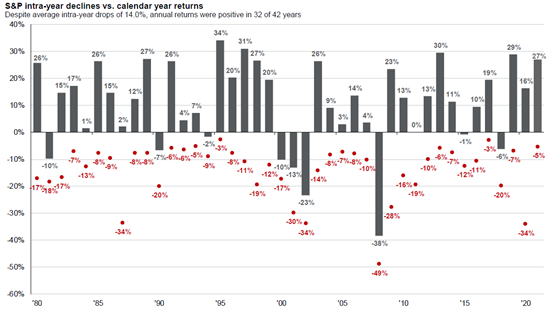

Equity selloffs will always be unsettling, but intra-year declines are a normal part of investing as shown below. Volatility is simply the price equity investors must pay for above average long-term returns.

Our base case for 2022 remains constructive. This said, there are potential headwinds investors will have to contend with this year. Government policy in response to the COVID pandemic is shifting back towards normal, and government supplied liquidity is fading. While the U.S. economy is now slowing from an artificially high rate of growth following the pandemic, we believe economic activity will remain elevated over historic trends for the balance of the year.

Thank you for your continued confidence in Clearwater Capital Partners. Please do not hesitate to reach out to us should you have any concerns or should you wish to discuss our strategies in greater detail.

John E. Chapman, Chief Investment Strategist

Tyler J. Beachler, Deputy Investment Strategist