Navigating Markets During Viral Outbreaks

/The latest medical outbreak has caused some investors to take a closer look at their portfolio strategies. As with any major news event, it is normal for investors to question how they might be positioned if a situation were to take a turn for the worse. Coronavirus has been no different for US investors as we begin to navigate 2020.

We have begun to receive calls from clients wanting to know how their portfolios are positioned for the ongoing Coronavirus outbreak. It’s a fair question, anytime there are headlines making waves like this has, it is an important pause point to make sure all your bases are covered.

Even as I sit here writing this post, CNBC is flashing bright red warnings of the potential impact on your portfolio that the latest outbreak could have. For CNBC’s sake, it is also convenient that the market is down almost 400 points (sarcasm.)

Coronavirus (specifically the “Wuhan Coronavirus”) is a deadly flu epidemic that at the time of this writing has killed 102 people, with over 4,682 people infected so far across the globe. So far there have been 5 confirmed cases in the United States. A serious medical situation certainly, but does such a headline warrant any serious portfolio adjustments?

During moments like this, it is always important to look at history. History and market precedent always provide a good base and context by which to analyze current situations like the topic at hand.

In my lifetime there have been about 11 medical related outbreaks that have taken headlines by storm. The Pneumonic Plague, Swine Flu, Ebola. These are all familiar to you and you likely recall the hysteria they rightly caused. However the financial media has historically attempted to connect viral medical headlines to a financial, or market related event. This is an important pause point because, as I have written in the past, it is the financial media’s JOB to relate headlines to portfolios,sssss so it is increasingly important to take an honest look at what is being said. This phenomenon is even exacerbated in modern times due to the 24 hour news cycle and social media presence facilitating the ability for things to go viral (no pun intended).

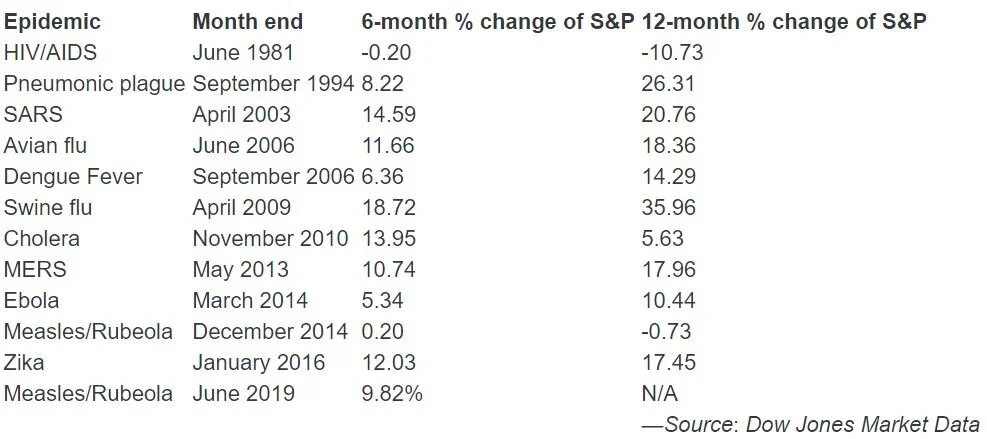

The Coronavirus has been increasingly compared to the SARS outbreak of 2002. The relation lies in the fact that SARS was also a particular type of Coronavirus and also began with a transfer from animals to humans. SARS went on to ultimately kill 744 people and infect over 8000 people. Economically speaking however, the S&P500 gained 14.56% after the first occurrence of SARS based on the end of month performance for the index in April, 2003. About 12 months after that point, the broad-market benchmark was up 20.76% (Dow Jones Market Data).

The chart below overlays some of the major epidemics over the last 50 years and the S&P500. While it is certainly a zoomed out time period, it provides a nice visual timeline of these outbreaks.

When looking at the historical effect these viral outbreaks have had on markets, it seems that much of the financial hype is much to do about nothing. In only one of the circumstances did the market end the following 6 & 12 month time periods negative from the outbreak.

Interestingly enough, historically the market has experienced a decent rally coming off of many of the previous viral outbreaks.

The reason that investors look to these types of events as potentially damaging to their strategies is not entirely without merit. Typically the economic risk associated with these events is the adverse affect on travel, potentially causing a subsequent hit to local economies. This is usually why travel / entertainment companies are hit the hardest when these headlines flash across our screens. Airline companies have been hit the hardest by the Coronavirus, with United Airlines, Delta, and American Airlines down more than 4% on Monday. Even booking companies like Expedia and Tripadvisor are down more than 2% as a result. China has already taken precautions that put this phenomenon into reality. At the time of this writing Beijing has shut down certain parts of the great wall. They have also shut down 16 cities which is estimated to have restricted the movement of almost 46 million people.

The timing for the Coronavirus, however, could not be worse for China and the potential implications it could have for their economy. The outbreak began in the midst of their Lunar New Year, a widely important holiday where travel and consumer spending is at all time highs. Events related to the Lunar New year have also begun to be cancelled. These troubles are set against a backdrop of a declining Chinese economy. Last year China’s GDP growth slowed to 6.1% which was the lowest reading for Beijing in nearly three decades.

According to Bloomberg, Hong Kong announced restrictions on travel from mainland China. They will close some border checkpoints, restrict travel on flights, trains and ferries. Starbucks and WeWork have shut down locations and Goldman Sachs has instructed all employee’s to stay home.

While the worries are based on reasonable concerns, only time will tell how this epidemic plays out. History is important and, as it shows us, the market’s reaction to events like this is typically short lived. The Coronavirus is undoubtedly a serious epidemic that has had some truly devastating affects, but at this time we do not believe its severity should dictate portfolio action. As with anything, knee jerk reactions to portfolio strategy are not advised.

If you have any questions about this post, please feel free to reach out to us.